Performance at Glance

Are you looking for a reliable and efficient payroll management solution for your business? Look no further than QuickBooks! With its user-friendly interface, extensive features, and comprehensive support, QuickBooks accounting has become a go-to solution for many businesses.

But don’t just take our word for it – let’s take a closer look at the performance of QuickBooks Payroll by examining its ratings from industry experts and customer reviews.

| | |

| | QuickBooks has an intuitive interface that is easy to navigate and use. |

| |

QuickBooks offers a range of support options, including email, phone, and chat support. |

| | QuickBooks offers comprehensive financial management features and integrates with other business tools. |

| |

QuickBooks can be challenging to set up, especially for first-time users. |

| | QuickBooks has received high ratings on G2, with users praising its ease of use and comprehensive features. |

Features of QuickBooks

When it comes to managing payroll for your business, having the right tools at your disposal can make all the difference. QuickBooks Payroll is packed with features designed to streamline the payroll process and help ensure compliance with tax laws and regulations. From employee self-service portals to automated tax calculations and filing, QuickBooks Payroll has it all.

Let’s take a closer look at some of the most important features of QuickBooks Payroll. So, dive in and explore what QuickBooks Payroll has to offer!

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Data Import & Export Tool | |

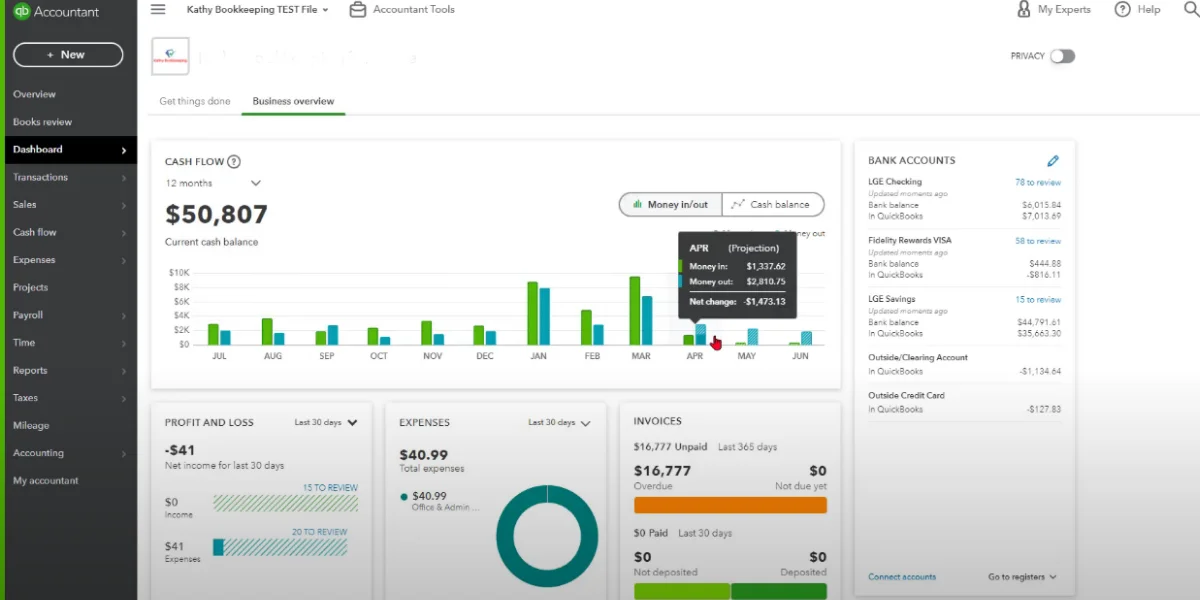

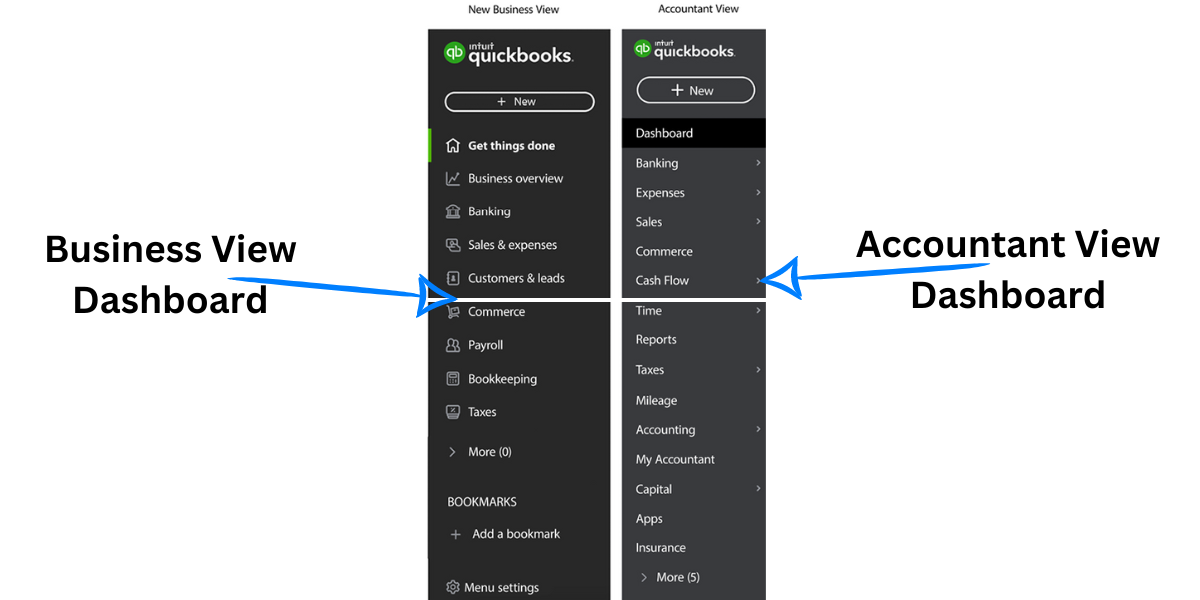

QuickBooks Dashboards

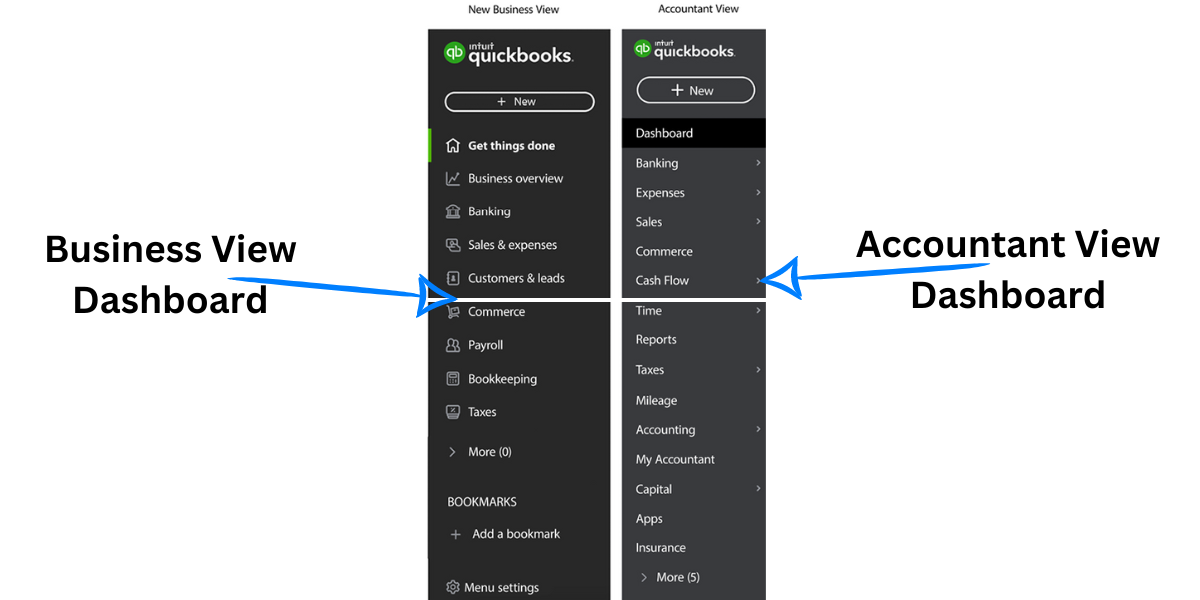

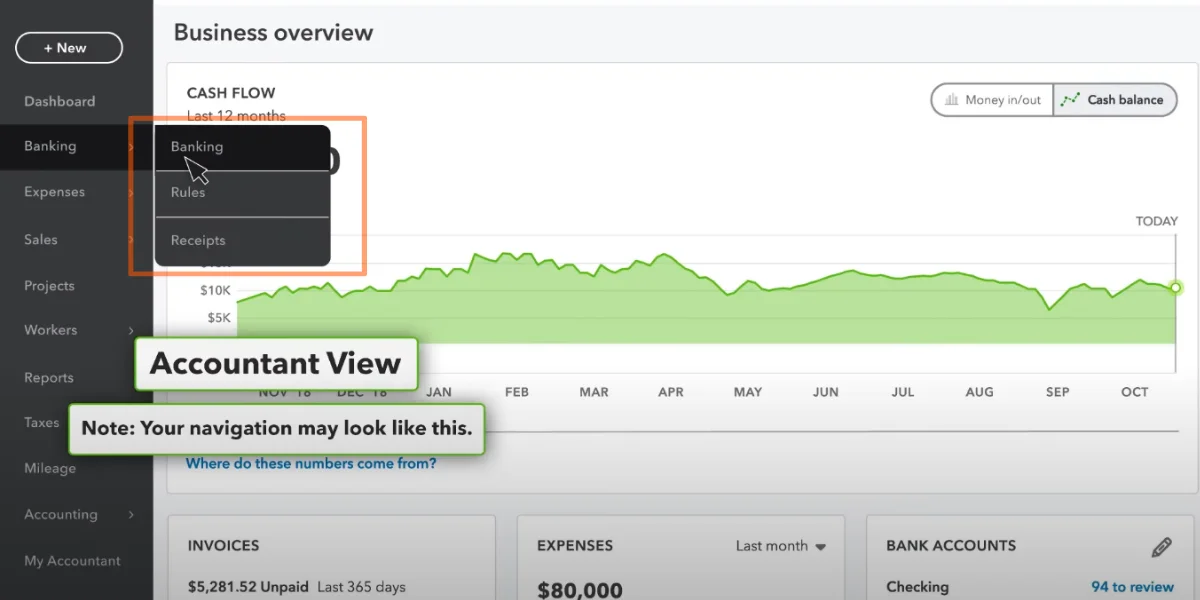

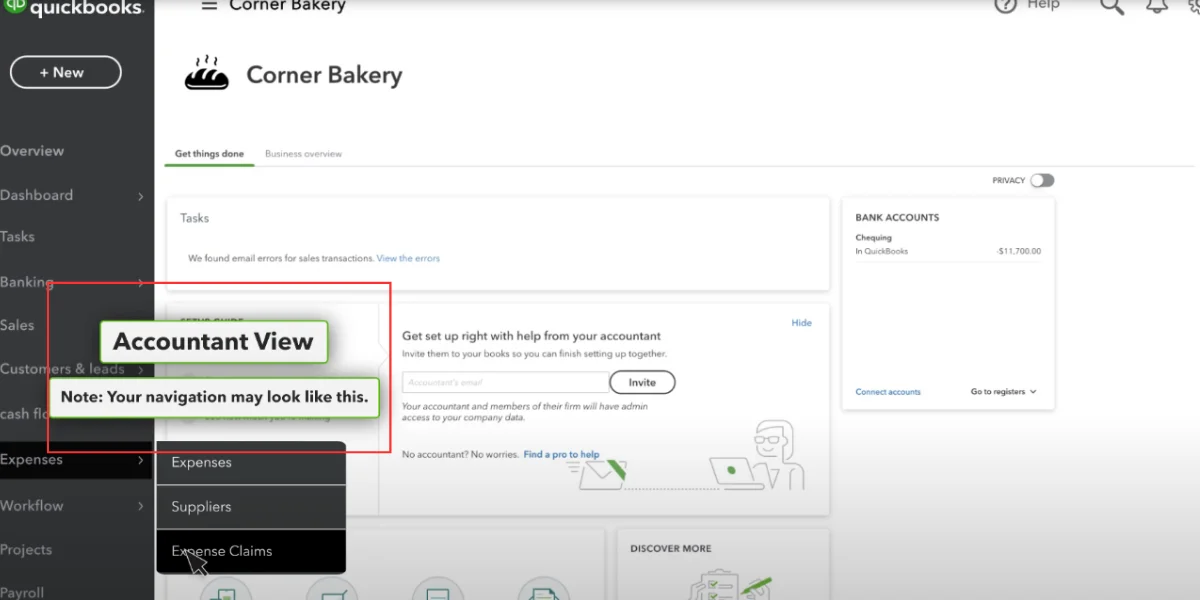

The QuickBooks dashboard provides users with a comprehensive overview of their financial data and key metrics. It is divided into two distinct segments: the business view and the accountant view.

-

Business View: Designed For Business Owners And Managers

It offers a user-friendly interface that displays essential information for monitoring and managing the financial health of the business. Users can view real-time data on income and expenses, track invoices and payments, review bank account balances, and generate reports to analyze profitability and cash flow.

-

Accountant View: Designed For Accounting Professionals

It provides a centralized platform for accountants to access multiple client accounts, streamline workflows, and efficiently manage financial tasks. Accountants can view client financial data, reconcile accounts, generate tax reports, collaborate with clients, and ensure accurate and compliant financial records.

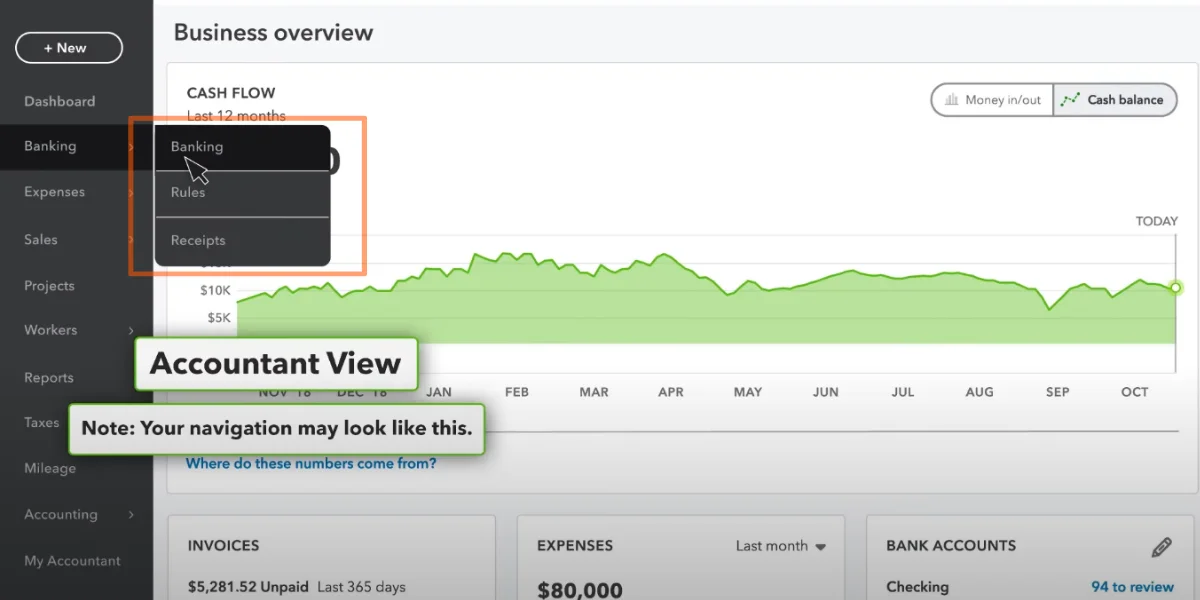

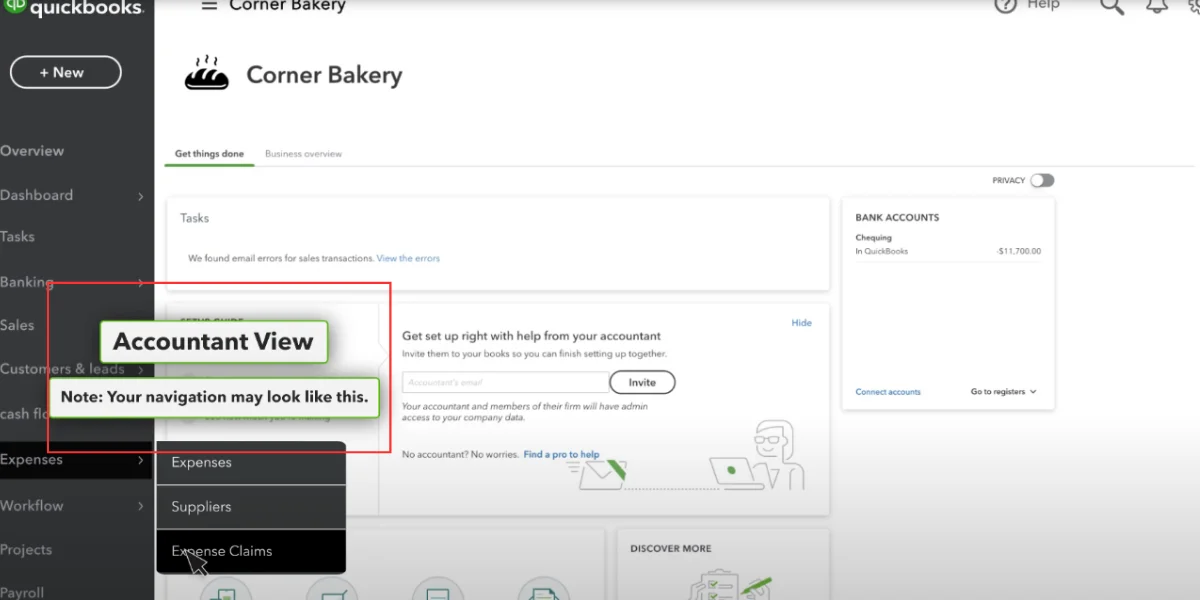

Comparing The Two: “Business View” & “Accountant View” Dashboards

In QuickBooks Online, there are two views available: the Accountant View and the Business View. Although both views allow you to perform similar tasks, the way you access the commands may vary depending on the view you are using. When switching between the views, you will notice changes primarily in the interface, such as the names of the links for the Navigation Bar commands.

The Business View in QuickBooks Online simplifies the interface to prioritize day-to-day business tasks, allowing business owners to efficiently manage their daily operations.

The Accountant View in QuickBooks Online offers a comprehensive range of business and accounting tasks, providing accountants with the necessary tools to handle various financial aspects.

Let’s proceed further to get in-depth information about both the views of QuickBooks Online.

QuickBooks “Business View” Dashboard Overview

The QuickBooks “Business View” dashboard provides businesses with a holistic overview of their financial performance. With an intuitive and user-friendly interface, this dashboard presents key metrics and data in a visually engaging format. It allows businesses to monitor important aspects such as income, expenses, profit and loss, cash flow, and outstanding invoices at a glance. By utilizing this dashboard, businesses can gain valuable insights, identify trends, and make informed decisions to optimize their financial strategies and drive growth.

Benefits Of Using Business View Dashboard

-

Real-Time Data Visualization:

The dashboard provides businesses with up-to-date and visually appealing representations of their key performance metrics, allowing for quick and easy monitoring of important information.

-

Enhanced Decision-Making:

By having a consolidated view of critical data, businesses can make informed decisions based on accurate and timely information, leading to improved business strategies and outcomes.

The dashboard allows businesses to analyze large volumes of data quickly and efficiently. It provides various visualization tools, such as charts and graphs, that simplify complex information and highlight trends or patterns.

-

Focus On Important Metrics:

The dashboard enables businesses to prioritize and focus on the key metrics that matter most to their operations. This helps in identifying strengths, weaknesses, and areas that require attention.

-

Improved Financial Management:

With a clear view of income, expenses, cash flow, and other financial indicators, businesses can effectively manage their finances, identify areas for cost optimization, and ensure healthy financial performance.

-

Quick Identification Of Anomalies:

The dashboard helps in spotting anomalies or deviations from expected patterns. Businesses can promptly investigate and address any irregularities, minimizing potential risks and improving overall operational efficiency.

-

Streamlined Communication:

The dashboard provides a centralized platform for sharing information and insights across departments and teams. It promotes collaboration, aligns goals, and facilitates data-driven discussions and decision-making.

-

Time-Saving And Efficiency:

Instead of manually gathering and analyzing data from multiple sources, the dashboard automates the process, saving time and effort. Businesses can focus on interpreting the data and taking action rather than collecting it.

-

Goal Tracking And Progress Monitoring:

The dashboard allows businesses to set goals, track progress, and measure performance against targets. It provides a clear view of achievements, motivating teams and driving continuous improvement.

The dashboard promotes transparency by providing stakeholders with access to relevant information. This transparency fosters trust, accountability, and effective communication within the organization.

The dashboard often offers customization options, allowing businesses to tailor the view and metrics according to their specific needs and preferences.

As businesses grow and evolve, the dashboard can accommodate expanding data sets and adapt to changing requirements, ensuring its usefulness over the long term.

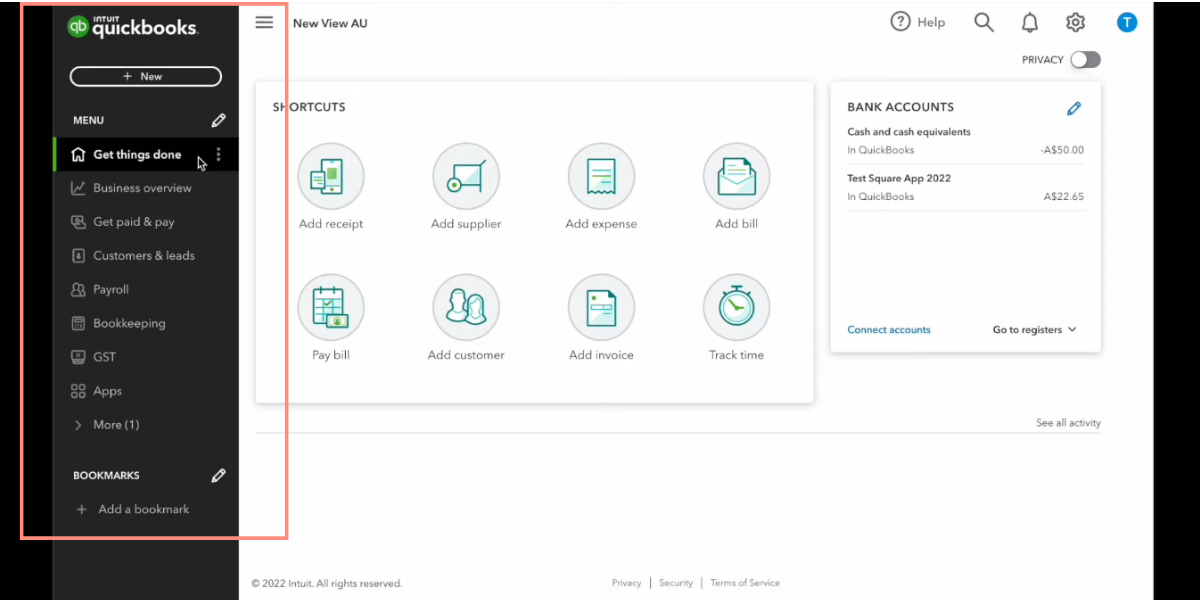

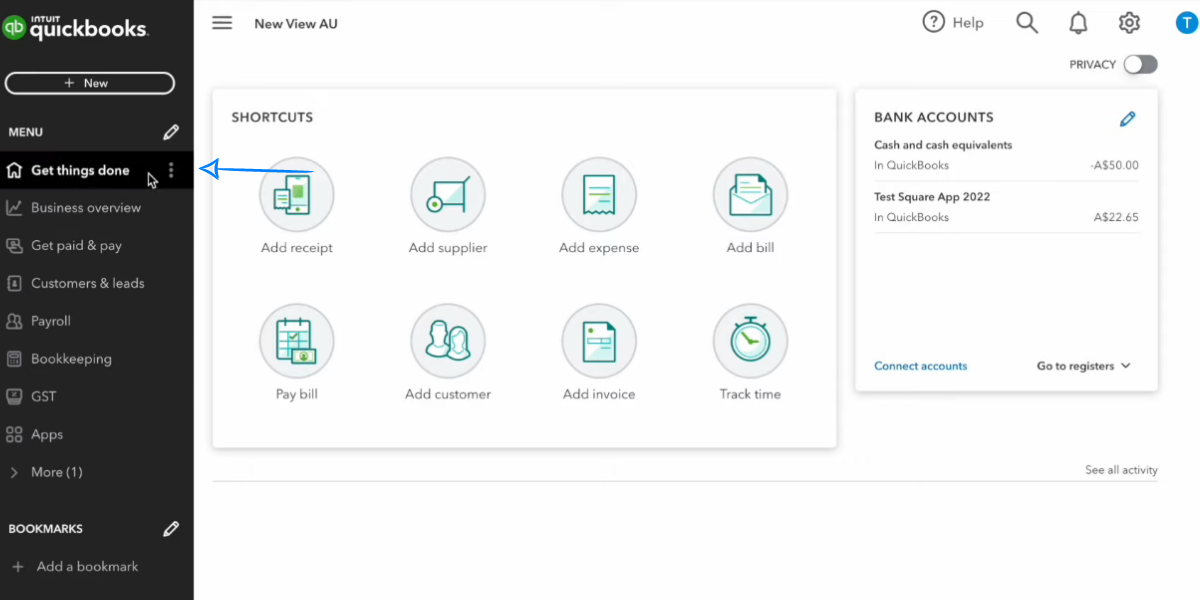

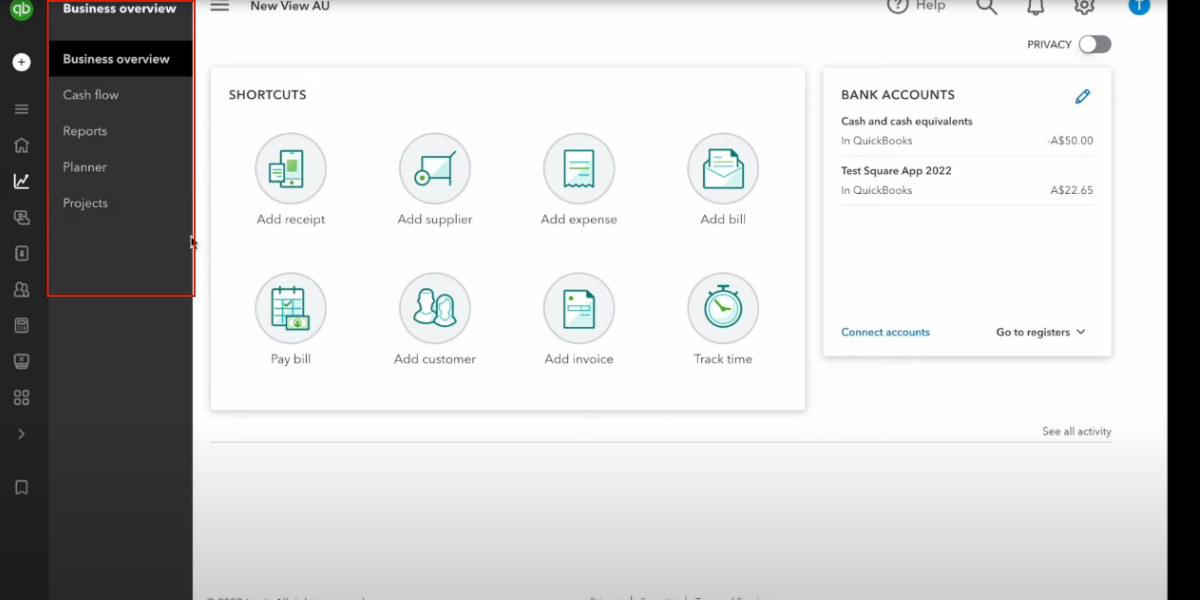

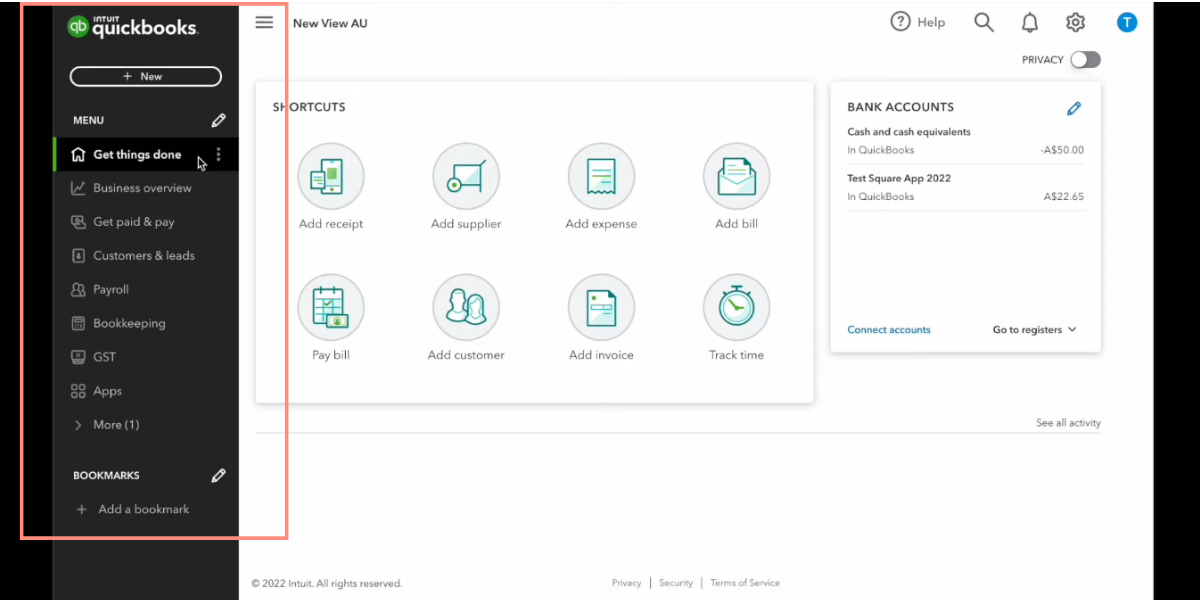

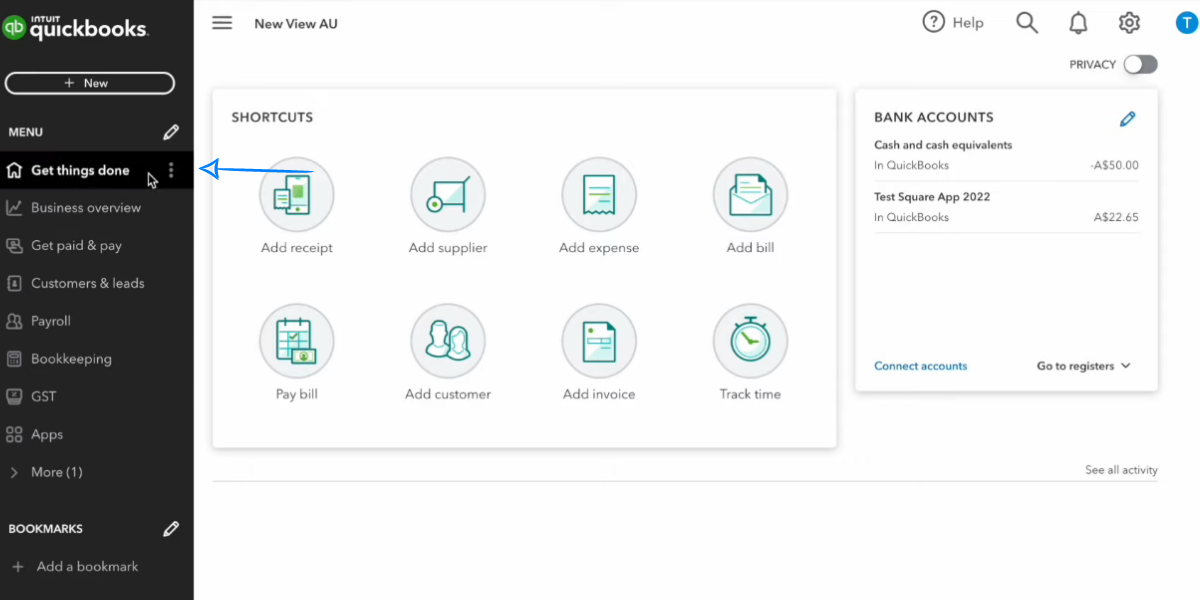

The Dashboard For Business View

To access your dashboard, simply navigate to the QuickBooks homepage. Once there, you will find two primary tabs on display on the right corner of the Dashboard.

- Business View

- Accountant View

Click on the “Business View” tab to enter the dashboard. Once you have enabled it, you will find the following features on the left side of the dashboard.

- Get Things Done

- Business Overview

- Get Paid & Pay

- Customer & Leads

- Payroll

- Bookkeeping

- GST

- Apps

Let’s move forward in the post to get a brief overview of every feature in the Business View Dashboard.

Get Things Done

Within the Get things done tab, you’ll encounter three types of services: shortcuts, ‘discover more’ (offering assistance on setting up QuickBooks), and bank accounts.

The setup guide will guide you through the process of configuring your company activities, such as navigating your account, customizing your invoice template, and setting up tax information.

Shortcuts prove valuable for easier navigation of QuickBooks features, saving time on frequently performed tasks like linking bank accounts, creating invoices, categorizing transactions and tracking receipts

The bank accounts option displays the balance of your currently connected account within QuickBooks Online.

Features Of QuickBooks’s “Get Things Done”

-

Creating And Managing Tasks:

QuickBooks allows you to create tasks and assign them to yourself or other team members. Tasks can be related to various activities, such as invoicing, bill payment, customer follow-up, or general business operations.

-

Setting Due Dates And Priorities:

When creating a task, you can specify a due date to ensure timely completion. Additionally, you can set priorities to indicate the urgency or importance of each task, helping you stay organized and focused on what needs to be done.

-

Adding Notes And Attachments:

QuickBooks enables you to add notes and attachments to tasks. This feature allows you to provide additional details, instructions, or context for a specific task. You can also attach relevant files or documents to tasks, making it convenient to access all the necessary information in one place.

The “Get Things Done” feature provides a task list that displays all your assigned tasks and their relevant details, such as due dates, priorities, and notes. This consolidated view helps you stay on top of your tasks and ensures nothing falls through the cracks.

-

Customizing Your Task List:

QuickBooks offers customization options to tailor your task list according to your preferences. You can adjust the display settings, sort tasks by due dates or priorities, apply filters to view specific tasks, and organize tasks into different categories or projects. These customization options allow you to personalize the task management experience and align it with your workflow.

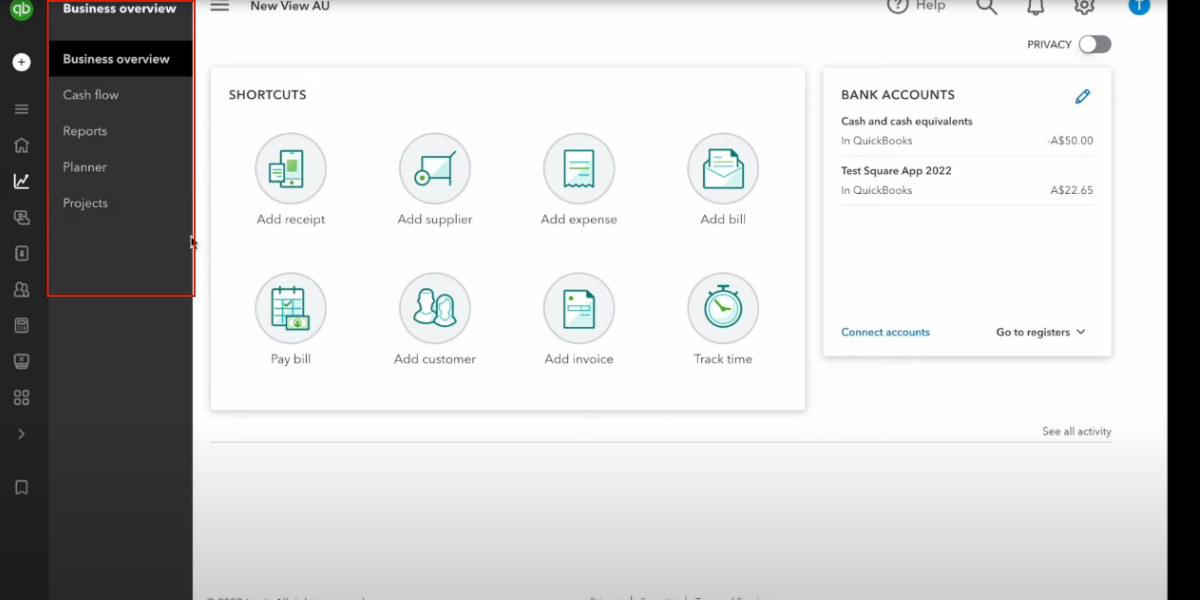

Business Overview

The Business Overview tab is a tool that provides a comprehensive view of your business’s financial health and performance. It serves as a central hub for organizing and managing your financial data, allowing you to make informed decisions and gain valuable insights. With a focus on profitability, this tab offers key features that assist you in understanding the financial health of your business.

Here are the components you’ll find on the Business Overview tab:

QuickBooks’ Business Overview tab includes a cash flow section that allows you to monitor and analyze the flow of money in and out of your business. It provides a visual representation of your cash inflows and outflows, helping you understand your business’s cash position.

Within the Business Overview tab, you’ll have access to various reports that offer detailed insights into your business’s financial performance. These reports can cover a wide range of areas, including sales, expenses, profitability, and more. By analyzing these reports, you can gain a better understanding of your business’s financial strengths and weaknesses.

The Planner feature in QuickBooks enables you to create and manage financial goals and forecasts for your business. It allows you to set targets, track progress, and compare your actual financial performance against your planned objectives. The Planner helps you stay organized and work towards achieving your business’s financial targets.

QuickBooks’ Business Overview tab may also provide a section dedicated to managing projects. This feature allows you to track income, expenses, and profitability associated with specific projects or jobs. By monitoring project-related financials, you can assess the profitability of individual projects and make informed decisions about resource allocation and project management.

These features collectively help you gain a clear view of your business’s profitability and financial performance. By organizing your finances and using the insights provided by the Business Overview tab, you can make informed decisions to drive the growth and success of your business.

Benefits Of Using QuickBooks “Business Overview”

-

Track Your Business Performance:

The “Business Overview” provides a consolidated view of key financial metrics, such as income, expenses, sales, and profit and loss. It allows you to easily monitor the performance of your business in real-time, giving you insights into how your business is doing financially.

-

Stay On Top Of Your Finances:

With the “Business Overview,” you can quickly assess the status of your income and expenses. It provides a clear snapshot of your cash flow, allowing you to identify any financial challenges or opportunities. This helps you maintain better control over your finances and make necessary adjustments as needed.

The “Business Overview” enables you to identify trends in your financial data. By analyzing patterns and comparing data over different time periods, you can gain valuable insights into how your business is growing or changing. This information can help you make strategic decisions and plan for the future.

With a comprehensive view of your financial performance, you can make informed decisions for your business. The “Business Overview” provides you with the necessary information to evaluate the profitability of different aspects of your business, assess the impact of your strategies, and determine the best course of action to achieve your goals.

[Related: Benefit of Quickbooks]

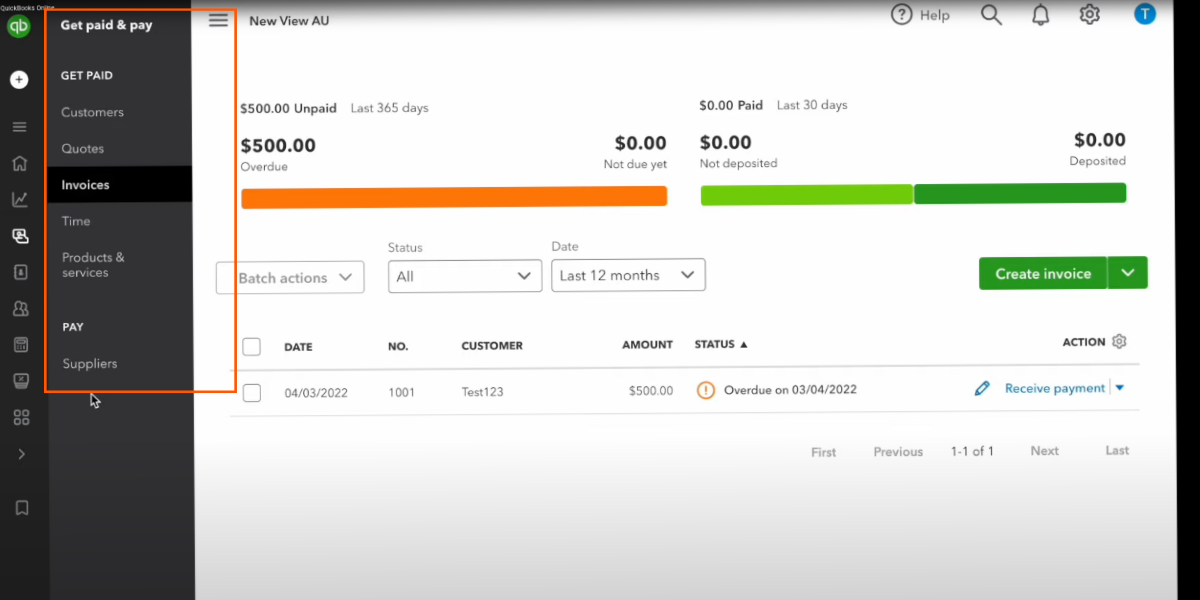

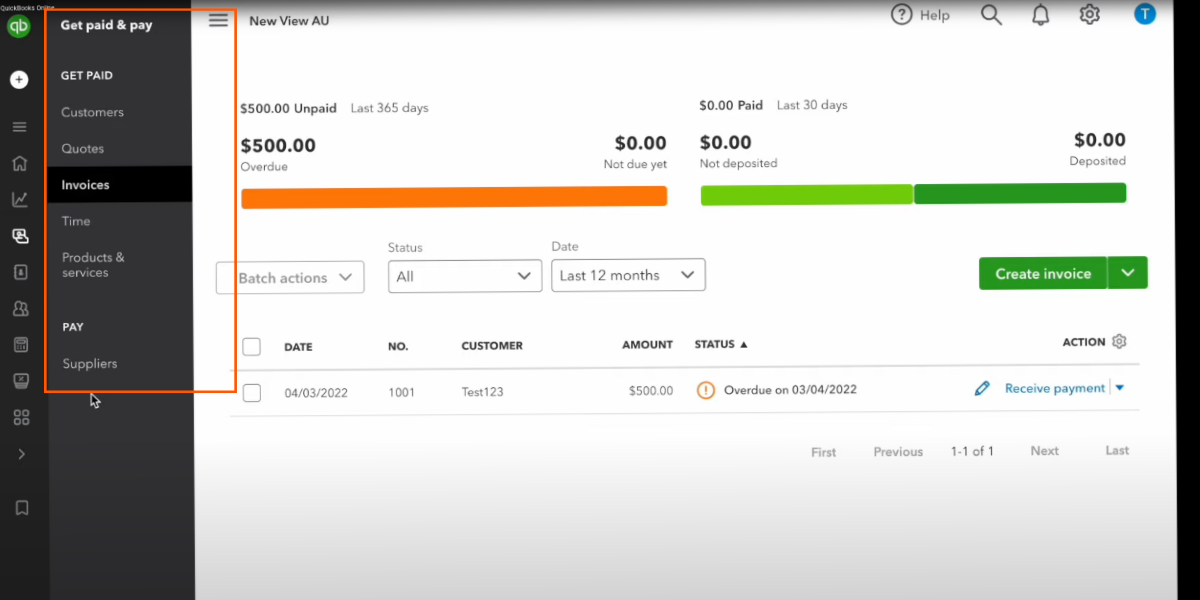

Get Paid & Pay

The Get Paid & Pay tab in the Business View dashboard of QuickBooks is a crucial section that focuses on managing the financial transactions related to sales and expenses. It offers a range of features to streamline and simplify the process of sending invoices, receiving payments, paying suppliers, and managing your products and services.

Features Of QuickBooks “Get Paid & Pay”

Here’s a detailed breakdown of the functionalities you can find in the Get Paid & Pay tab:

You can customize the invoices with your business branding, add line items for products or services sold, specify quantities and prices, and include any applicable taxes or discounts. Once created, you can easily send the invoices and quotes to your customers via email directly from QuickBooks. It simplifies the billing process and helps you track and manage your receivables efficiently.

With QuickBooks, you can easily record and track customer payments within the Get Paid & Pay tab. When you receive payments from your customers, you can record them against the corresponding invoices. QuickBooks also enables you to accept online payments, allowing your customers to pay invoices conveniently through various payment methods. It streamlines the payment collection process, improves cash flow, and maintains accurate records.

You can track and record the bills or expenses incurred by your business, set up payment schedules, and process payments directly from QuickBooks. This functionality helps you stay organized, ensures timely payments, and maintains good relationships with your suppliers.

-

Product and Service Management:

Within the Get Paid & Pay tab, you can create and maintain a centralized product and service list. This includes information such as item descriptions, prices, SKU numbers, and inventory quantities. By keeping your product and service information up to date in QuickBooks, you can easily include them in your invoices, track sales, and monitor inventory levels.

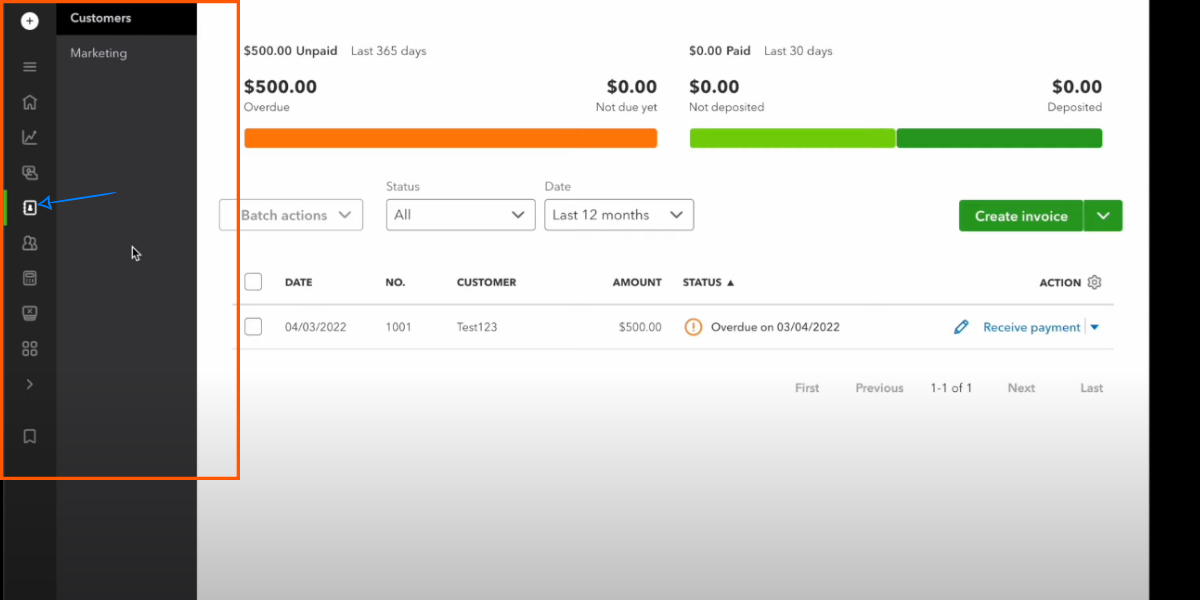

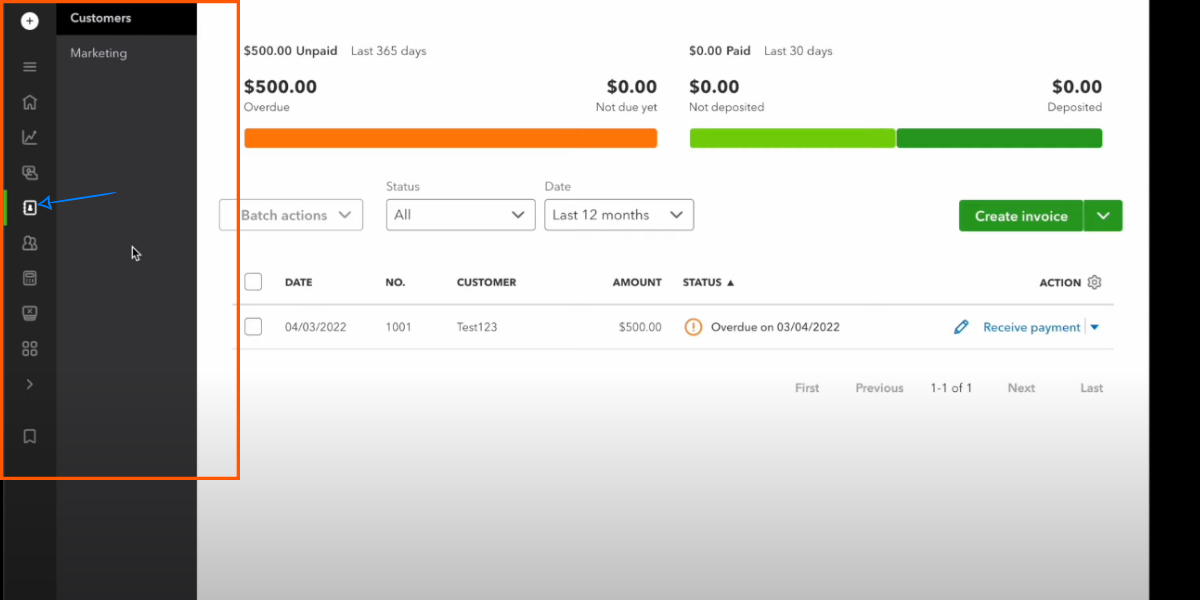

Customer & Leads

The Customers & Leads is a feature-rich dashboard designed to help businesses manage and track their customer information effectively. It provides various tools and functionalities to streamline customer management and boost business growth. It offers you to expand your business with marketing by MailChimp.

Features & Benefits Of QuickBooks “Customer & Leads”

-

Setup and Track Customers:

The Customers & Leads tab allows you to set up and manage your customer database efficiently. You can easily add new customers, input their contact details, and maintain a comprehensive record of their transactions, invoices, and payments. This feature enables you to keep track of customer interactions, monitor outstanding balances, and ensure timely payments.

Within this tab, you can communicate with your customers directly by sending messages or emails. This functionality facilitates easy and seamless communication, allowing you to address customer queries, provide updates, and build stronger relationships.

QuickBooks enables you to segment your customer base based on specific criteria. This segmentation feature assists in categorizing customers into different groups, such as demographics, purchase history, or preferences. By creating customer segments, you can personalize your marketing campaigns and tailor offers to specific target audiences.

-

Customer Transaction History:

The Customers & Leads tab provides a comprehensive overview of each customer’s transaction history. You can easily access details of invoices, payments, and sales receipts associated with a particular customer. This information is valuable for tracking customer interactions, identifying repeat customers, and analyzing their purchasing patterns.

-

Marketing Integration with MailChimp:

QuickBooks offers integration with MailChimp, a popular email marketing platform. This integration allows you to leverage the power of email marketing to grow your business. By connecting QuickBooks with MailChimp, you can sync customer data, create targeted email campaigns, and track the effectiveness of your marketing efforts. This integration helps you nurture leads, engage with customers, and drive sales through email marketing strategies.

-

Customer Notes and Reminders:

Within the tab, you can add notes and reminders associated with specific customers. This feature enables you to jot down important details, record special instructions, or set reminders for follow-up activities. These notes and reminders help you stay organized, ensure timely customer interactions, and deliver exceptional customer service.

-

Customer Reports and Analytics:

QuickBooks provides a range of reporting and analytics features within the Customers & Leads tab. You can generate reports that offer insights into customer sales, revenue trends, outstanding balances, and more. These reports help you evaluate customer performance, identify opportunities for improvement, and make data-driven decisions to optimize your business strategies.

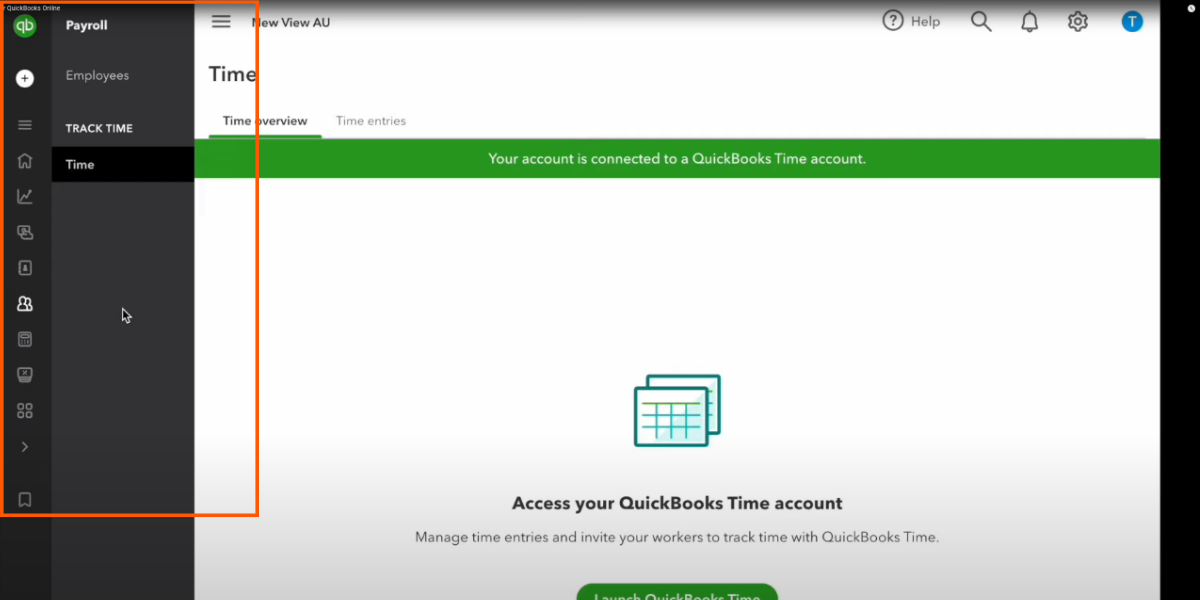

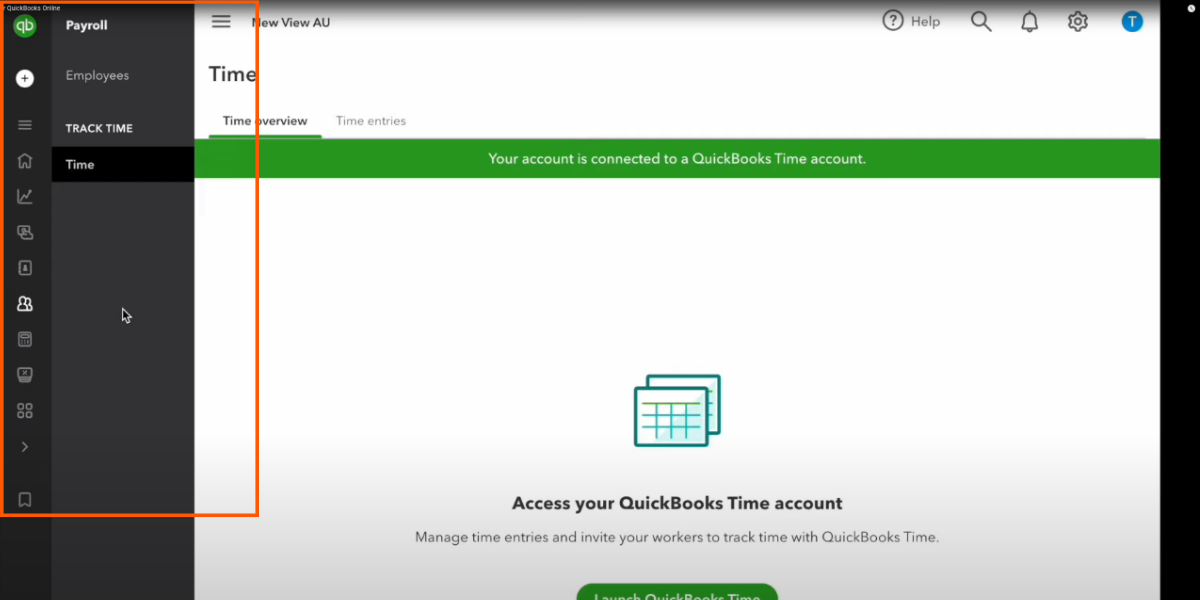

Payroll

The Payroll tab offers a comprehensive set of tools and features to manage and streamline payroll processes for your business. It integrates with QuickBooks Payroll powered by KeyPay, providing a seamless and efficient solution for managing employee payments. Additionally, it enables you to track employee time using QuickBooks Time.

Features & Benefits Of QuickBooks “Payroll”

Here is a detailed overview of the Payroll tab in QuickBooks, including its key functionalities and benefits:

-

Manage & Pay Your Employees

The Payroll tab allows you to manage and pay your employees using QuickBooks Payroll powered by KeyPay. This integration simplifies payroll processing by automating various tasks, such as calculating wages, deductions, and taxes. It ensures accurate and timely payroll management, reducing the administrative burden and minimizing the risk of errors.

-

Employee Payment Processing:

With the Payroll tab, you can efficiently process employee payments, including regular wages, bonuses, commissions, and reimbursements. It allows you to set up payment schedules, choose payment methods (such as direct deposit or physical checks), and generate pay stubs for each employee. This feature streamlines the payment process, making it easier to track and manage employee compensation.

-

Tax Calculation and Filing:

QuickBooks Payroll powered by KeyPay handles tax calculations automatically, taking into account the applicable federal, state, and local tax regulations. It calculates tax withholdings, prepares payroll tax forms, and generates reports for tax filing purposes. This functionality ensures accurate and compliant tax management, saving time and reducing the risk of penalties or fines.

The Payroll tab also integrates with QuickBooks Time, allowing you to track employee working hours, breaks, and overtime. This feature helps you accurately record employee attendance and ensures fair and compliant payment for their time worked. The integration streamlines the process by automatically syncing time data with payroll, eliminating the need for manual data entry and reducing errors.

QuickBooks Payroll provides an employee self-service portal, where employees can access their payroll information, pay stubs, tax forms, and time tracking data. This self-service functionality empowers employees to view and manage their own payroll-related information, reducing administrative overhead and fostering transparency.

-

Payroll Reporting and Analytics:

The Payroll tab offers a range of reporting and analytics features that provide insights into payroll expenses, employee costs, tax liabilities, and more. You can generate reports to track payroll trends, analyze labor costs, and monitor compliance. These reports enable you to make data-driven decisions, identify areas for cost optimization, and ensure accurate budgeting and financial planning.

-

Compliance and Legal Requirements:

QuickBooks Payroll helps you stay compliant with labor laws and regulations by automatically applying the latest tax rates, wage laws, and deductions. It assists in generating and filing necessary forms, such as W-2s and 1099s, at the end of the year. By managing payroll through QuickBooks, you can reduce the risk of non-compliance and ensure adherence to legal requirements.

-

Third-Party Integrations:

The Payroll tab supports integration with various third-party applications and services. It allows you to connect and sync data with other HR and accounting systems, time tracking tools, and employee benefits platforms. These integrations provide a holistic view of employee-related data and streamline processes across different systems.

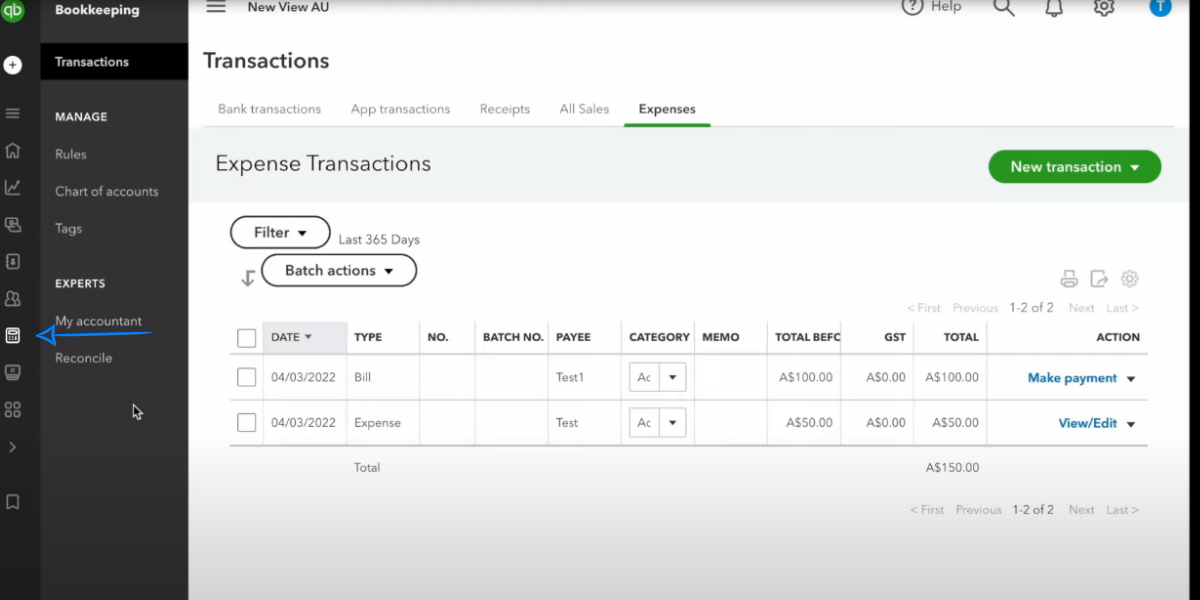

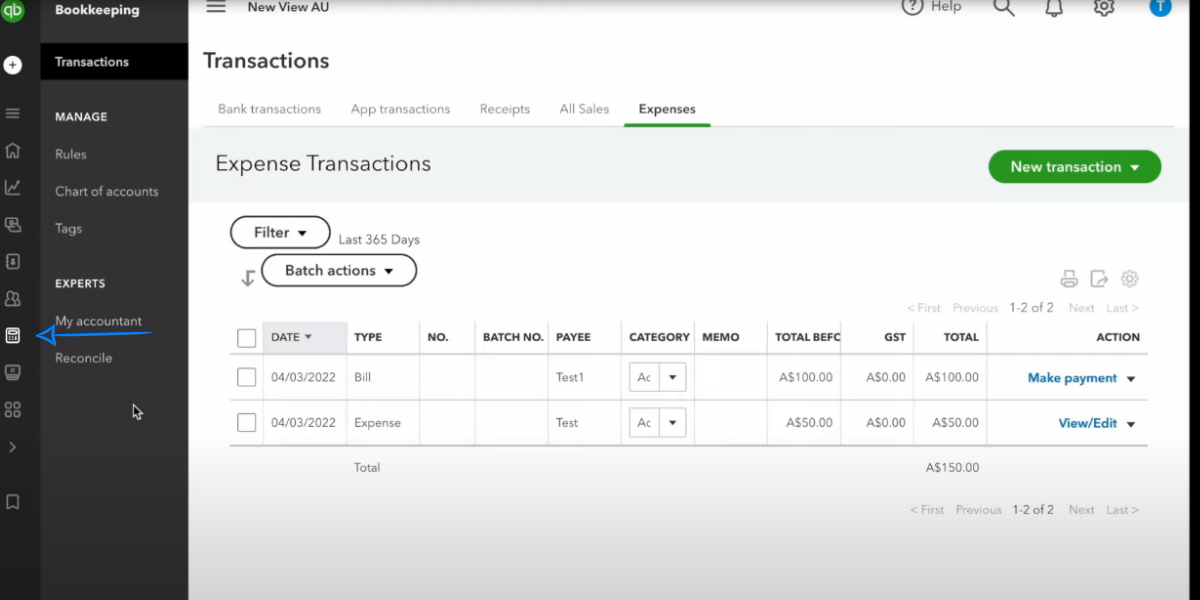

Bookkeeping

The Bookkeeping tab in QuickBooks Business View dashboard is a valuable tool that assists businesses in maintaining accurate and organized financial records. It provides a range of features and functionalities to ensure that your accounting stays on track.

Features & Benefits Of QuickBooks “Bookkeeping”

It helps you keep your accounting in order by providing a centralized platform to manage your financial data. It allows you to store and organize all your business transactions, invoices, receipts, and other financial documents in a digital format. This feature ensures that your financial information is easily accessible and well-organized for efficient bookkeeping.

-

Bank Account Reconciliation:

QuickBooks enables you to reconcile your bank accounts directly from the Bookkeeping tab. This process involves matching your recorded transactions with those in your bank statements, ensuring that your financial records accurately reflect your actual bank balances. Bank account reconciliation helps identify any discrepancies or errors, providing a clear and accurate view of your business finances.

Within the Bookkeeping tab, you can efficiently manage your business expenses. You can record and categorize expenses, track vendor payments, and generate expense reports. This feature enables you to monitor and control your spending, analyze expense patterns, and make informed decisions to optimize your business finances.

-

Collaboration with Bookkeeper or Accountant:

QuickBooks allows you to invite your bookkeeper or accountant to work on your books directly from the Bookkeeping tab. By granting access to these professionals, you can collaborate with them in real-time, ensuring accurate and up-to-date financial data. This feature simplifies the process of working with your bookkeeping or accounting team and streamlines the flow of information.

It provides a comprehensive Chart of Accounts, which is a categorized list of all the accounts used in your business’s financial transactions. It allows you to customize and organize accounts based on your business needs. This feature helps maintain consistency and accuracy in your financial reporting and analysis.

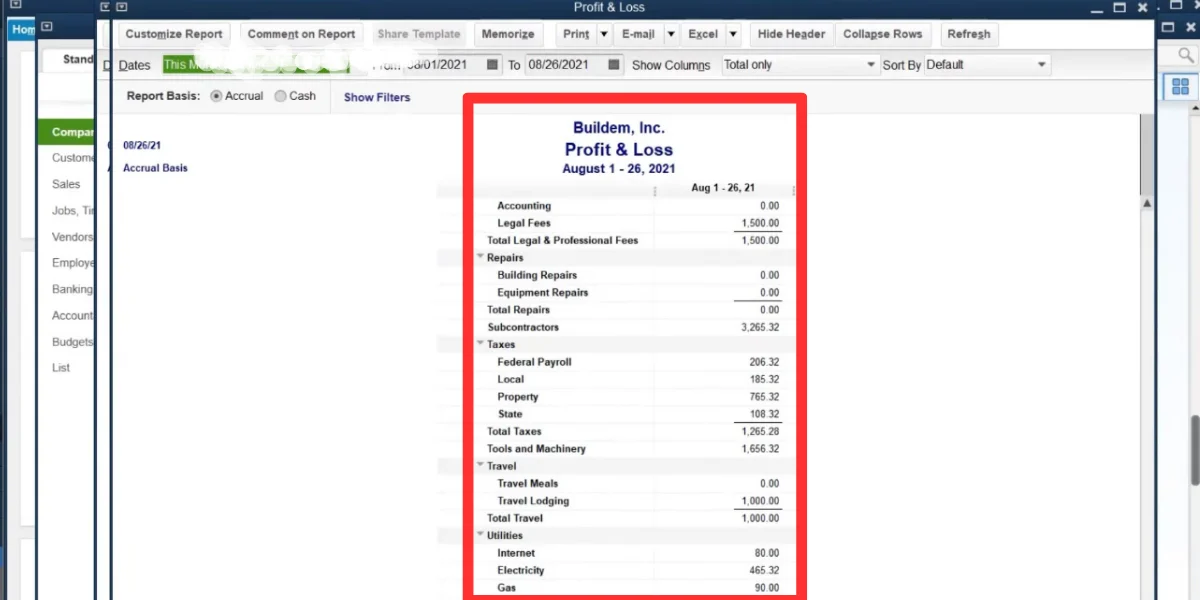

QuickBooks offers a wide range of financial reports within the Bookkeeping tab. These reports provide valuable insights into your business’s financial performance, including profit and loss statements, balance sheets, cash flow statements, and more. You can customize and generate these reports to gain a deeper understanding of your business’s financial health and make informed strategic decisions.

-

Integration with Other QuickBooks Features:

The Bookkeeping tab seamlessly integrates with other features and modules within QuickBooks. For example, it syncs with the Payroll and Expenses tabs, allowing for easy access to payroll data and expense tracking. This integration ensures that your bookkeeping remains consistent and accurate across different aspects of your business.

-

Automation and Efficiency:

QuickBooks automates many bookkeeping tasks, such as transaction categorization and bank reconciliation. This automation saves you time and minimizes the chances of human error. By streamlining these processes, the Bookkeeping tab helps you focus on more strategic aspects of your business while maintaining accurate financial records.

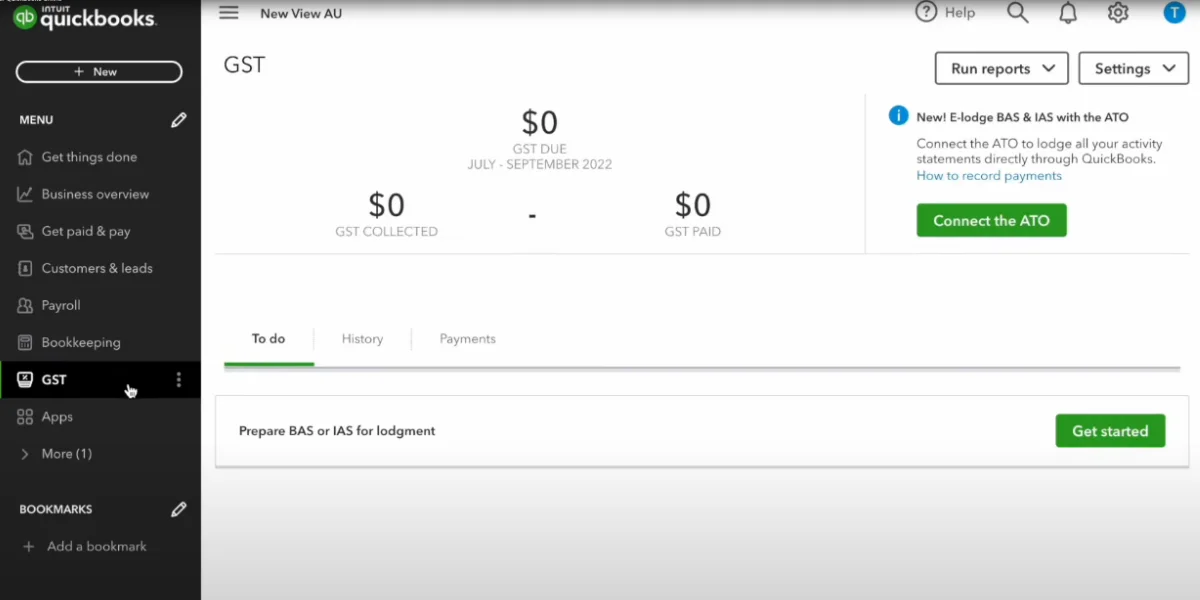

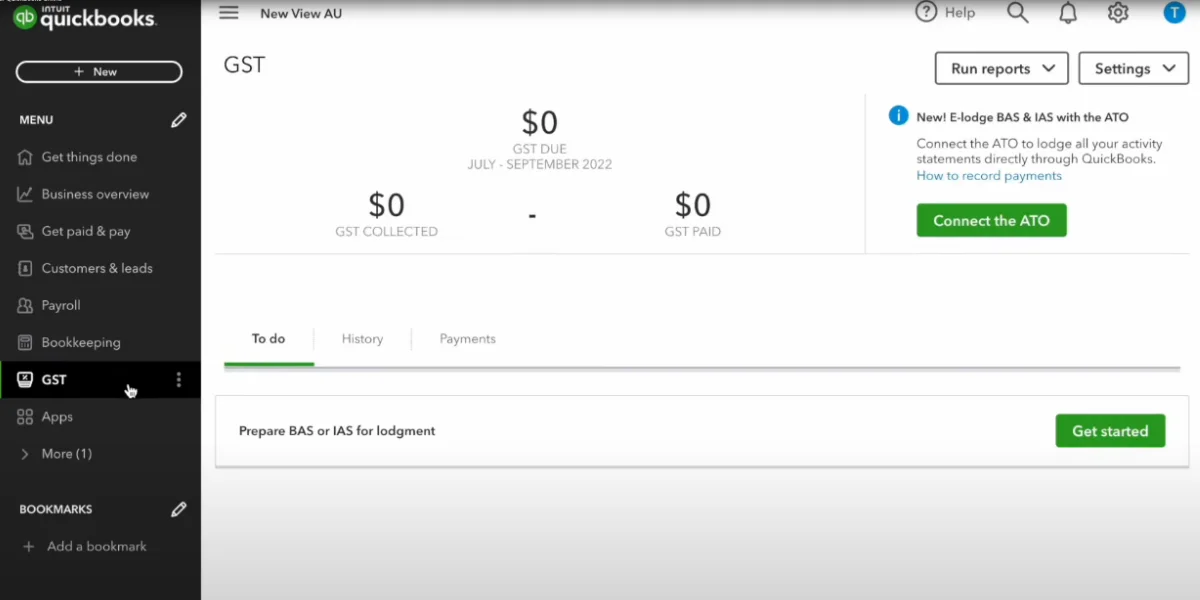

GST

The GST (Goods and Services Tax) tab in the Business Overview dashboard of QuickBooks provides businesses with a dedicated section to manage and track their GST-related activities. This tab is particularly useful for businesses operating in regions where GST is applicable.

Features & Benefits Of QuickBooks “GST”

Here is a detailed overview of the GST tab in QuickBooks, including its key features and benefits:

The tab allows you to conveniently access the Tax Center within QuickBooks. The Tax Center serves as a centralized hub for all your GST-related tasks and information. From the GST tab, you can easily navigate to the Tax Center, where you can find various tools and resources to manage your GST obligations.

-

GST Tracking and Reporting:

QuickBooks provides features to track and report on your GST transactions. It helps you accurately record GST collected on sales and paid on purchases. QuickBooks automatically calculates the GST amounts based on your transaction data, simplifying the process of GST tracking and reporting. This functionality ensures compliance with GST regulations and streamlines your tax management processes.

-

GST Invoices and Tax Codes:

QuickBooks enables you to create GST-compliant invoices and apply the appropriate tax codes to your sales transactions. You can select the appropriate GST tax rate for each item or service sold, ensuring accurate calculation and recording of GST amounts. This feature helps streamline your invoicing process while ensuring GST compliance.

It allows you to reconcile your GST amounts. You can compare the GST amounts recorded in QuickBooks with your official GST reports to ensure accuracy and identify any discrepancies. This reconciliation process helps you maintain the integrity of your GST records and enables you to identify and resolve any issues promptly.

QuickBooks offers a range of GST reports that provide insights into your GST transactions, including sales, purchases, tax liabilities, and more. You can generate GST reports to review your GST-related activities, verify compliance, and prepare for tax filing. These reports facilitate a better understanding of your GST obligations and help you make informed financial decisions.

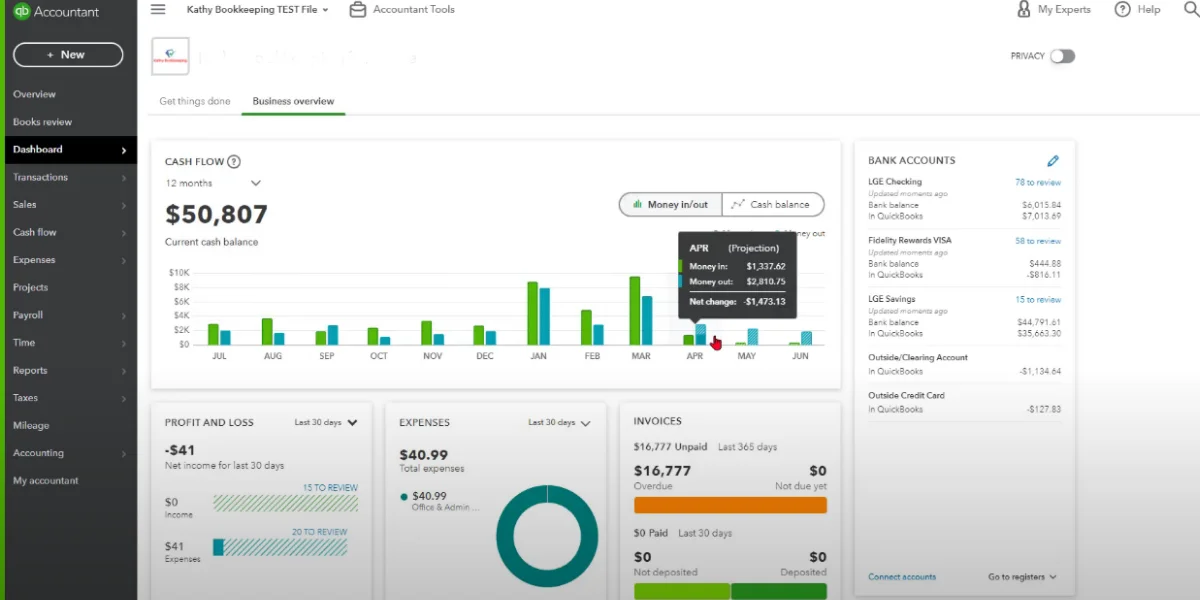

QuickBooks “Accountant View” Dashboard Overview

The Accountant View dashboard in QuickBooks Online is a powerful tool specifically designed for accountants to efficiently manage their clients’ businesses. It offers a comprehensive overview of key information and provides quick access to essential features. Let’s dive in to first understand the Overview Navigation Button:

The Overview navigation button is exclusively available to accountants. It serves as a gateway to access the Accountant View dashboard, which provides a consolidated snapshot of the client’s business. Here is a brief explanation of the features of this button:

The dashboard offers accountants a quick assessment of what is happening in their clients’ businesses. It provides a high-level view of important metrics, giving accountants a clear understanding of the overall financial health of the client’s business.

The dashboard displays information about the apps connected to the client’s QuickBooks account. Accountants can easily identify and manage the integrations between QuickBooks and other applications, ensuring seamless data flow and accurate financial reporting.

Accountants can review important client details directly from the dashboard. It includes information about the client’s subscription, payroll, and sales tax setup. This allows accountants to have a comprehensive understanding of the client’s setup and configuration.

The dashboard provides a detailed overview of the client’s banking activity. Accountants can view bank account balances, transactions, and reconcile accounts efficiently. This feature enables them to monitor cash flow, identify discrepancies, and ensure accurate financial records.

Accountants can analyze the transaction volume of the client based on different time frames such as 30 days, 60 days, 90 days, or 365 days. This feature provides insights into the client’s transaction trends, helping accountants identify periods of high activity and assess the overall financial performance.

Now let’s get in depth of the Dashboard Navigation Button of the Accountant’s View:

The Accountant View dashboard in QuickBooks Online offers accountants a detailed and comprehensive overview of their clients’ financial data. The dashboard includes quick graphical representations that provide visual insights into the client’s financial status. These visuals typically include charts or graphs displaying the client’s open invoices, expenses, bank balance, credit card balance, and quick profit and loss summary. These visuals allow accountants to quickly assess the client’s financial health and identify any significant trends or anomalies.

Overall, the Accountant View dashboard provides accountants with a detailed and organized display of their clients’ financial information. The graphical representations offer valuable insights for effective financial analysis and decision-making.

Benefits Of Using “Accountant View” Dashboard

-

Real-Time Financial Insights:

The Business View dashboard presents a snapshot of critical financial data, such as income, expenses, and bank account balances. This allows business owners to stay updated on their financial position and make informed decisions based on accurate and up-to-date information.

-

Streamlined Financial Management:

With the Business View dashboard, accountants can easily track invoices, manage payments, and review outstanding balances, all from a centralized platform. This streamlines the workflow, saves time, and improves efficiency in managing day-to-day financial operations.

-

Performance Monitoring and Analysis:

The dashboard enables you to monitor and analyze key performance indicators (KPIs). It generates reports on profitability, cash flow, and sales trends to gain insights into the business’s overall performance. This helps in identifying areas of strength and areas that require attention, allowing proactive decision-making to drive business growth.

-

Customization and Flexibility:

The Business View dashboard offers customization options to tailor the display of information according to business owners’ preferences. Users can rearrange and prioritize widgets, create personalized reports, and set up alerts for important financial events. This flexibility ensures that the dashboard aligns with specific business needs and provides a personalized experience.

-

Collaboration and Access Control:

The dashboard facilitates collaboration among team members and external stakeholders. Business owners can grant access to specific users, such as accountants or business partners, allowing them to view and analyze financial data. This enhances collaboration, enables timely communication, and fosters a collaborative approach to financial management.

How To Set Up Banking In QuickBooks?

Connecting your bank account to QuickBooks is one of the fastest ways to accurately record your company’s financial transactions. Let’s move forward to understand how to connect your bank account in QuickBooks and choose how far back you want QuickBooks to pull up your transaction history. So without further ado

Select “Banking” from the transaction menu.

There are two ways to bring in transactions from your bank accounts. First way is to connect your account so that QuickBooks can automatically download them. Second option is to download your company’s historical transactions from the bank in a file and then upload the file to QuickBooks.

NOTE- Connecting your account is a faster and easier way to set up banking in QuickBooks.

- Select your bank from the list of the popular financial institutions or you can simply add the name of the institution in the column to select.

- Then enter the username and the password that you use to login to your bank online banking.

- Each of the banks has its own security features and may require a few more steps to login.

- You can choose from the mentioned options to how you would like to receive the Registration Code – like Voice Call, SMS or EMail to verify your identity.

- Now you have to enter the security code issued to you by your bank to complete the signup process.

- Once you are done with the signup process. QuickBooks look for all the accounts that you have with your registered financial institution.

- Select each of the accounts that you may want to connect with QuickBooks (Only select the accounts that are relevant to your business).

- Once you have selected the bank accounts, you can select the duration of the transactions that you may want QuickBooks to access from the dropdown below.

- That’s it. Now you can check all the transactions of your bank accounts from the date you entered till today.

Now when the new transactions take place, they will automatically appear on the screen. You can choose to categorize your transactions so that QuickBooks adds them to the correct account.

Features Of QuickBooks Banking

-

Connect Your Bank Accounts:

QuickBooks allows you to connect your bank accounts directly to the software. By connecting your accounts, you can securely import bank transactions into QuickBooks, eliminating the need for manual data entry. This feature saves time and reduces the chances of errors in recording transactions.

Once your bank accounts are connected, you can download your bank transactions directly into QuickBooks. This includes information such as deposits, withdrawals, and transfers. QuickBooks supports automatic downloads from a wide range of financial institutions, making it convenient to import and categorize your transactions.

Reconciliation is an essential accounting process that ensures your records match the transactions and balances reported by your bank. QuickBooks provides a built-in reconciliation feature that allows you to compare your bank statement with the transactions recorded in QuickBooks. You can match and mark transactions as cleared, identify any discrepancies, and resolve them to maintain accurate financial records.

QuickBooks Banking helps you track your cash flow by providing real-time visibility into your income and expenses. As you import and categorize your bank transactions, QuickBooks automatically updates your cash flow statement, allowing you to monitor the flow of money in and out of your business. This feature helps you understand your financial health, make informed decisions, and plan for future expenses.

When you download transactions into QuickBooks, the software provides tools to categorize and classify them correctly. You can create rules and categories to automatically assign transactions to specific accounts or expense categories. This streamlines the process of organizing your financial data and ensures accurate reporting for tax purposes and financial analysis.

How To Manage Sales In QuickBooks?

QuickBooks is a popular accounting software used by many businesses to manage their financial transactions, including sales. Here are some relevant and professional tips on how to manage sales in QuickBooks:

-

Set Up Your Sales Accounts:

Start by setting up the necessary accounts in QuickBooks to track your sales. Create an income account specifically for tracking sales, such as “Sales Revenue” or “Product Sales.”

Customize your sales forms, such as invoices and sales receipts, to match your branding and include all the necessary details. QuickBooks provides customization options to add your logo, company information, and customize the layout of your sales forms.

-

Record Sales Transactions:

Enter sales transactions in QuickBooks accurately and promptly. You can create invoices for sales made on credit and sales receipts for immediate payments. Ensure that all relevant details, such as customer information, items sold, quantities, prices, and any applicable taxes, are recorded correctly.

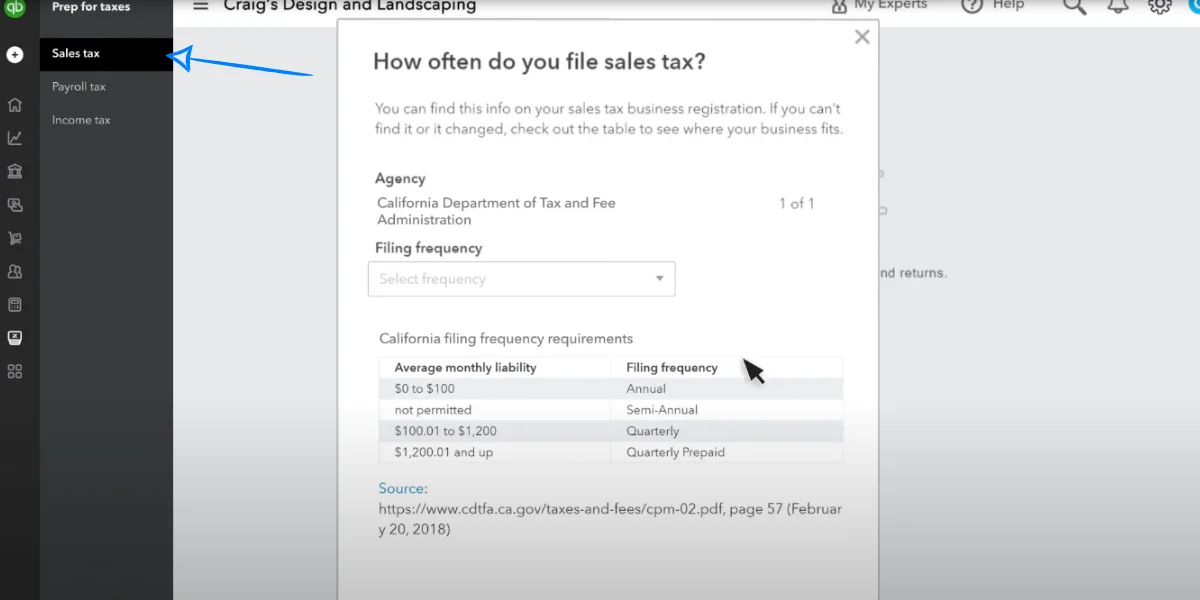

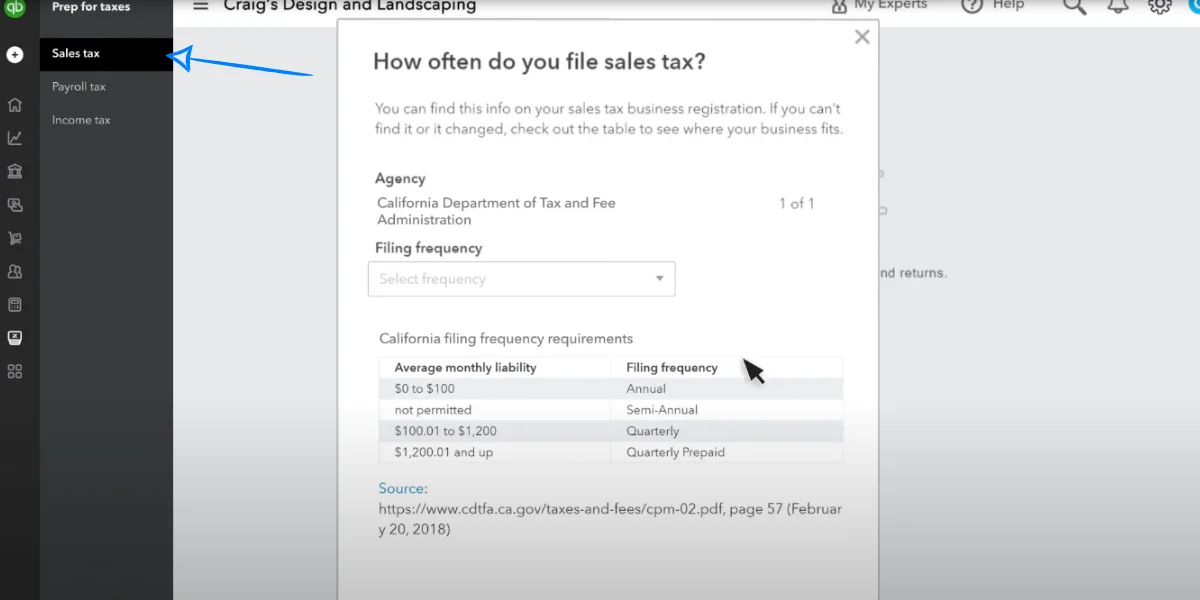

If your business is required to collect sales tax, set up the appropriate sales tax rates and rules in QuickBooks. You can assign the tax code to your products or services, and QuickBooks will automatically calculate the sales tax on your sales transactions.

When you receive payments from customers, record them in QuickBooks. You can match the payment to an existing invoice or create a new sales receipt. QuickBooks allows you to track outstanding balances, send payment reminders, and reconcile your accounts.

-

Monitor Accounts Receivable:

Keep an eye on your accounts receivable to track unpaid invoices and follow up with customers for payment. QuickBooks provides reports that show your outstanding invoices, aging of accounts receivable, and customer payment history.

Utilize QuickBooks’ reporting capabilities to gain insights into your sales performance. You can generate reports like sales by customer, sales by product, sales by date range, and more. These reports help you analyze your sales trends, identify your top-selling products or services, and make informed business decisions.

-

Regularly Reconcile Your Sales Transactions:

Reconciliation is essential to ensure your sales transactions in QuickBooks match your bank statements. Regularly compare your sales records with your bank deposits to identify any discrepancies and resolve them promptly.

Remember, these tips provide a general guideline for managing sales in QuickBooks. The specific steps and features may vary depending on the version of QuickBooks you’re using and your business needs. I

Features Of QuickBooks Sales

QuickBooks allows you to monitor your sales activity and gain insights into your business’s performance. You can track transactions, including sales orders, estimates, and invoices. It enables you to have a clear overview of your sales pipeline and monitor the progress of each sale from initiation to completion.

With QuickBooks, you can easily create professional-looking invoices for your customers. You can customize invoice templates with your company logo, contact information, and payment terms. The software also allows you to add line items for products or services sold, specify quantities and prices, and calculate taxes and discounts automatically. Invoices can be generated and sent directly to customers via email or printed for mailing.

-

Manage Leads And Opportunities:

You can create and maintain a database of leads, including their contact information, interactions, and notes with QuickBooks. As leads progress through the sales process, you can convert them into opportunities and track their status, probability of closing, and estimated revenue. This feature enables you to prioritize and focus on potential sales that have a higher chance of conversion.

With QuickBooks you can keep track of customer payments, ensuring accurate and up-to-date financial records. You can record payments received, whether in the form of cash, checks, or electronic methods. The software also enables you to reconcile customer payments with invoices, automatically updating the accounts receivable balance. This feature provides visibility into outstanding payments, helps manage cash flow, and facilitates timely follow-up on overdue invoices.

QuickBooks provides a range of customizable reports that offer insights into sales performance, such as sales by customer, sales by product or service, and sales by sales representative. These reports can help identify trends, analyze sales patterns, and make data-driven decisions to optimize sales strategies.

How To Track Expenses In QuickBooks?

You might be wondering that tracking your expenses can be a thorn in your path. But like it is said, with knowledge comes power. With a better understanding of how to track your expenses properly, you will help your business to run smoothly. Here a few simple ideas for building a useful expense tracking system:

-

Create A Business Bank Account:

Establishing a separate bank account dedicated solely to your business transactions is essential. This segregation not only simplifies expense tracking but also enhances financial transparency. By keeping personal and business finances separate, you can accurately identify and record business-related expenses, making financial reporting and auditing processes much smoother.

-

Stay On Top Of Your Receipts:

Receipts are tangible evidence of business expenses and serve as crucial supporting documents during tax filing and financial audits. Adopting a disciplined approach to collecting and organizing receipts is paramount. Create a designated system, such as a folder or digital repository, to store and categorize receipts promptly. Regularly review and reconcile your receipts with your financial records to ensure accuracy.

-

Take Special Note Of All Business Travel:

Business travel expenses can significantly impact your bottom line. It is essential to meticulously document all expenses related to business trips, including transportation, lodging, meals, and incidental costs. To simplify the process, consider using dedicated travel expense apps or platforms that allow you to capture and categorize expenses in real-time. Additionally, keeping a log of business-related activities during the trip can help provide context and justification for the expenses incurred.

-

Note Your Expenses As They Occur:

Timely recording of expenses minimizes the risk of overlooking or forgetting vital details. Adopt a proactive approach by noting your expenses as they happen. Utilize a designated notebook, mobile app, or digital spreadsheet to record pertinent information, such as the date, vendor name, purpose, amount, and relevant category. This habit will save you time and effort when reconciling expenses later on.

-

Use Software To Track And Analyze Business Purchases:

Leveraging specialized expense tracking software can greatly simplify the process of monitoring and analyzing business purchases. These tools often offer features like automated expense categorization, integration with bank accounts and credit cards, receipt scanning, and robust reporting capabilities. By digitizing the expense tracking process, businesses can streamline workflows, minimize human errors, and gain valuable insights into spending patterns and trends.

As your business grows, managing expenses can become increasingly complex and time-consuming. Engaging a professional bookkeeper or accountant can alleviate this burden and ensure accurate and compliant financial record-keeping. Bookkeepers possess the expertise to categorize expenses, reconcile accounts, and generate financial reports, enabling you to focus on core business activities while maintaining financial transparency.

Features Of QuickBooks Expenses

Easily monitor and keep a record of all business expenses in one place using QuickBooks Expenses. This feature allows you to capture and track expenses incurred for various purposes, such as office supplies, travel, meals, and more.

With this feature, you can generate comprehensive reports that consolidate and summarize all the expenses incurred within a specific period. Expense reports can be customized to include relevant details, such as expenses by category, vendor, or employee.

QuickBooks Expenses allows you to set budgets for different expense categories, departments, or projects. By tracking actual expenses against budgeted amounts, you can monitor spending, identify areas of overspending or underspending, and make informed financial decisions.

It is crucial for organizing and analyzing financial data. QuickBooks Expenses allows you to categorize expenses based on predefined categories or create custom categories. By categorizing expenses, you can gain insights into spending patterns, track expenses by specific categories, and improve cost control.

How To Manage Employees In QuickBooks?

Managing employees in QuickBooks involves various tasks. Here are the steps to manage employees in QuickBooks software:

Set Up Roles That Include Expense Claims:

- Go to Settings and select Manage Users.

- Click on Roles.

- Assign a role that includes the expense claim permission to employees who need to enter expense claims.

- Confirm their access to Expense Claims by selecting Edit, then Expenses.

Set Up Expense Claim Settings:

- Navigate to Sales & Expenses and select Expense Claims.

- Click on Manage Settings.

- View the roles and users with permission to submit expense claims.

Provide Employees With Appropriate Expense Categories:

- Select the Category drop-down menu.

- Choose relevant categories.

- Assign a Nickname for each category to help employees easily identify and select the appropriate category when submitting expenses.

- Save and set up all necessary categories.

Customize Team’s Expense Submission View:

- Select Manage Expense Form.

- Enable or disable their ability to submit customer or project details, class, or location for each expense.

Employee Expense Submission Process:

- Manually enter expense details or upload a picture of the receipt.

- QuickBooks will extract relevant information.

- Assign a category and provide additional purchase details.

Admin Review And Management Of Expenses:

- Receive notifications for new expenses to review.

- Review the information, make necessary adjustments, and save the expense to add it to the books.

- Use the Expense Claims tab to track and manage pending and reviewed expenses.

- Track and manage expenses in QuickBooks Online Advanced.

Follow the above steps to set up the team

Features Of QuickBooks Employees Management

to submit expenses and effectively track them.

-

Track Employee Information:

QuickBooks allows you to maintain comprehensive records of your employees, including personal details, contact information, employment history, and other relevant data. This centralized employee database simplifies the management of employee information.

-

Create And Manage Payroll:

QuickBooks provides payroll management tools that streamline the process of calculating and distributing employee salaries, taxes, and deductions. You can set up payroll schedules, automate payroll calculations, and generate pay stubs, ensuring accurate and timely payroll management.

-

Track Time And Attendance:

With QuickBooks, you can track and manage employee time and attendance. This includes recording hours worked, tracking overtime, and managing time-off requests. The time tracking feature helps in accurate payroll calculations and provides insights into employee productivity.

QuickBooks allows you to manage employee benefits such as health insurance, retirement plans, and other employee perks. You can track benefit deductions, enroll employees in benefit programs, and streamline benefit administration.

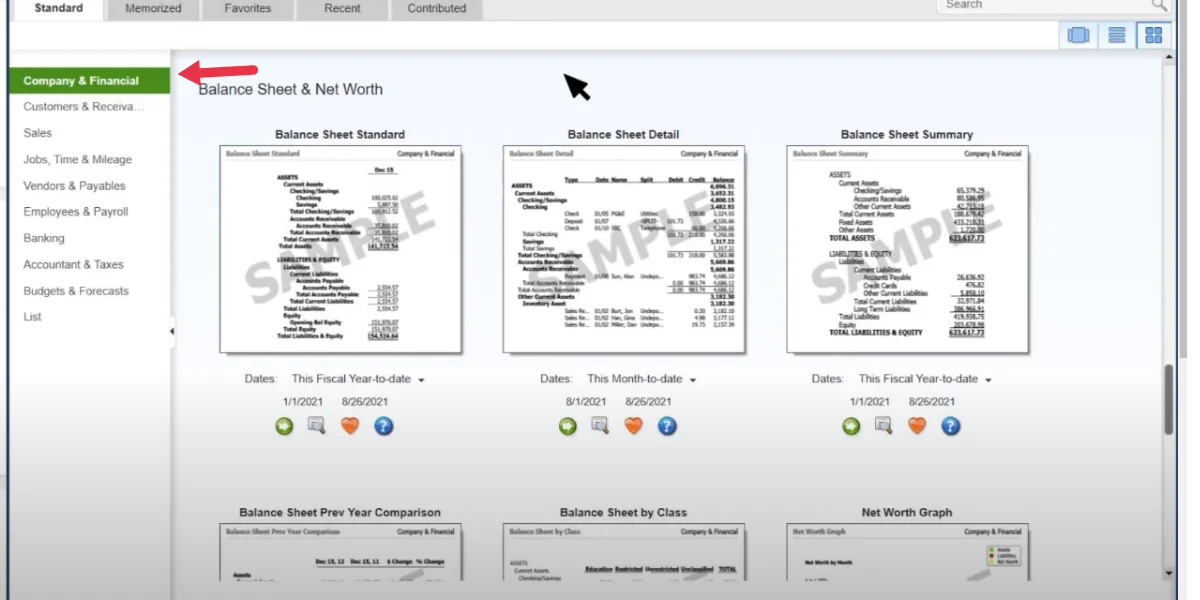

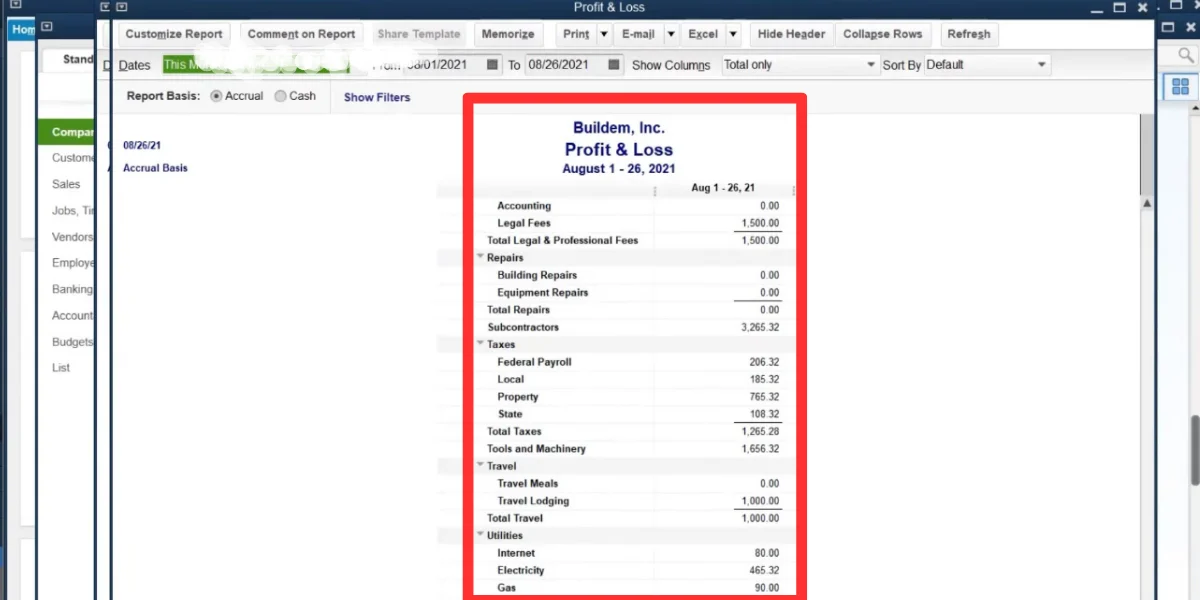

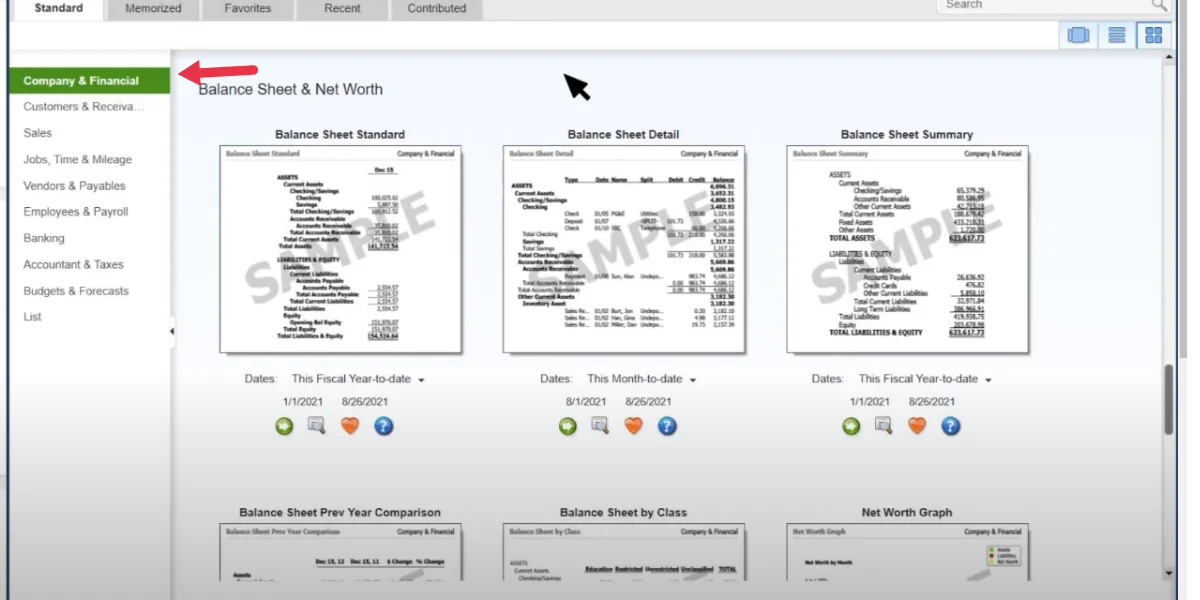

How To Create Quickbooks Reports?

You have the flexibility to organize your company’s financial data according to your preferences by either using a pre-built report or customizing your own. This grants you the freedom to tailor your reports to meet your specific needs and visualize the data in the way you desire. If you are using QuickBooks online simple start, essentials or plus, here is the process of customizing your reports:

Creating A Custom Report

You can create custom reports through the use of filters. If you are yet to do so, then sign in to QuickBooks online as an administrator. Once you are signed in, follow the steps below:

- Navigate to the Business Overview section.

- Click on the Reports tab.

- Choose the option to “+Create new report”.

- Select the desired report type from the available options.

- Click on the “Create” button to proceed.

- To customize the report, click on the pencil icon ?.

- Enter or edit the name of your report as needed.

- Click “Save” to access and modify your report as needed.

- Select “Export” to store and retrieve report data in a spreadsheet format for future reference or analysis.

Visualize The Report

To enhance the presentation of your report data, QuickBooks offers a chart view feature that allows you to create visually appealing charts. Here’s how you can utilize this feature:

- Open your custom report in QuickBooks.

- Select the “Chart View” option to switch to the chart view mode.

- Choose the desired chart type that best represents your data.

- Adjust the fields displayed on the Horizontal (X) axis and the Vertical (Y) axis by selecting the appropriate options from the dropdown menus.

- Once you have configured the chart to your satisfaction, select “Save” to save your settings.

By utilizing the chart view feature in QuickBooks, you can transform your report data into visually engaging charts, making it easier to understand and present your business insights effectively.

Features Of QuickBooks Reports

QuickBooks allows you to create customized reports tailored to your specific business needs. You can select the desired data fields, apply filters, and arrange the layout to generate reports that provide relevant insights into your business finances.

-

Export Reports To Excel Or PDF:

The software provides the option to export reports to popular file formats such as Excel or PDF. This enables you to save, share, and further analyze the report data outside of the QuickBooks software.

-

Share Reports With Others:

You can easily share reports with team members, stakeholders, or accountants directly from QuickBooks. This collaboration feature allows others to access and review the reports, facilitating better communication and informed decision-making.

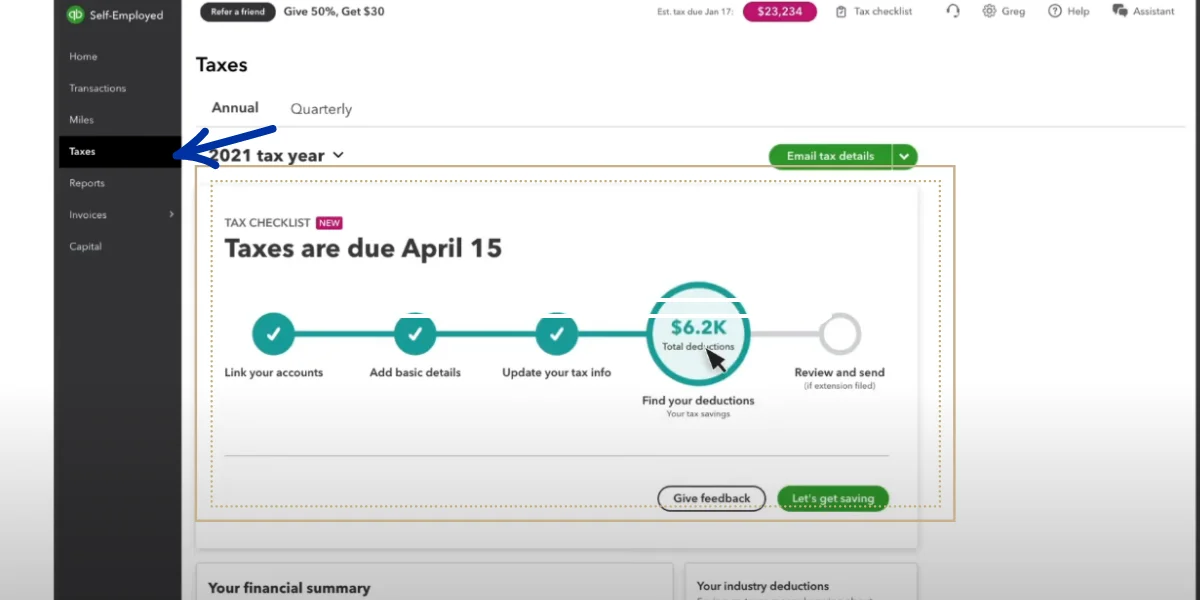

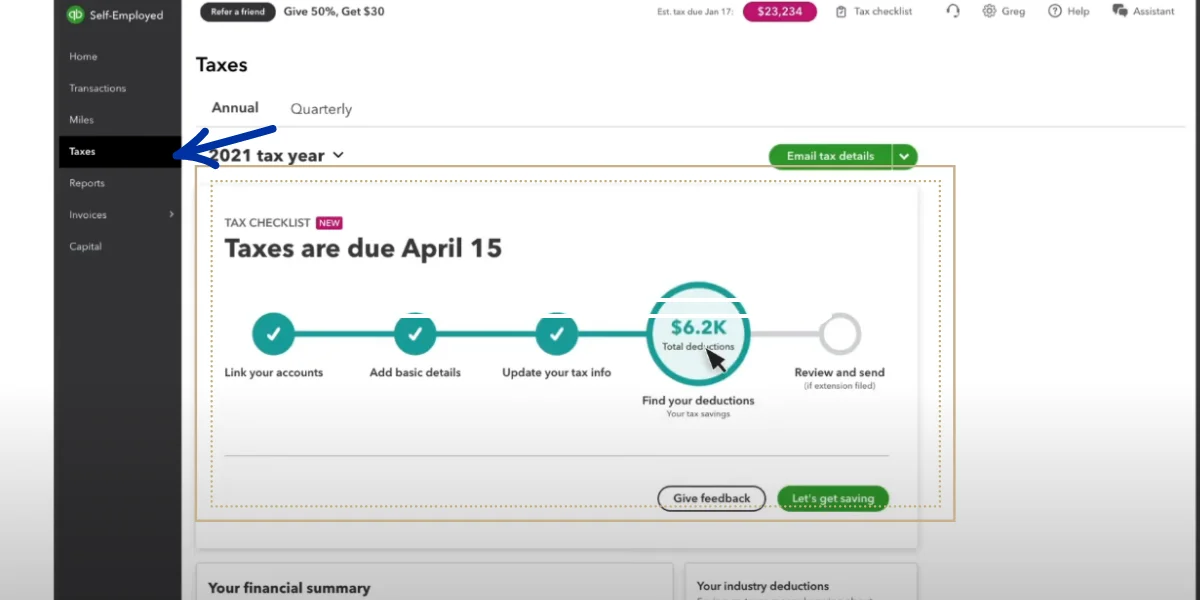

How To Use QuickBooks To File Your Taxes?

Are you ready to file your business taxes? Here is a quick guide for you to file your taxes in a few steps:

-

Collect Your Records For Filing Taxes

To accurately report your business income and qualified expenses, it is important to gather all relevant company records. This involves collecting supporting documents pertaining to payroll, sales, purchases, and other eligible business expenses. When preparing your taxes, it is recommended to compile the following small business documents:

NOTE – Having a detailed record of your business expenses of the year can help you lower your tax liability.

Using tax software to track your expenses and transactions throughout the year is still easier than figuring it all out at the end of the year.

-

Keep A Note Of The IRS Forms You May Need To File

The types of form you will need to fill out for filing small business taxes depends on your business structure. Here is a list of some of the small business taxes you need to file your tax returns:

-

Fill The Small Business Tax Forms

When completing your small business tax forms, it is crucial to meticulously follow each step and provide accurate information. If you are using Schedule C, the form is relatively simpler, consisting of only two pages.

Forms 1065, 1120, and 1120S are more comprehensive and may require additional time to complete. It is important to be prepared with all the necessary information and have your supporting documents readily available before starting the form.

Filling out tax forms can be challenging for the average taxpayer. To avoid overlooking any essential details, it is advisable to utilize accounting software and other resources to stay organized and ensure compliance.

-

Know The Tax Filing Deadlines

In certain tax years, it is possible for the due date of your personal income tax return or small business tax return to coincide with a holiday or a weekend. In such cases, the new tax deadline is moved to the next business day.

As a business owner, you are well aware of the significance of staying organized. From managing invoices and inventory to handling payroll and employees, organization plays a vital role. Ensuring you stay organized regarding the due date of your business taxes is equally essential.

-

File For Extension If Needed

If you require more time, you have the option to request a business tax extension using Form 7004. This form allows for a six-month extension to file your taxes, but it does not extend the time to make payments. It is important to submit the extension before the deadline to avoid penalties.

Failing to file an extension and missing the tax filing deadline may result in the Failure to File Penalty. This penalty is imposed if you do not submit your taxes on time and amounts to 5% of your unpaid taxes for each month or part of the month that your small business tax return is delayed.

-

File Your Small Business Taxes

E-filing offers a quicker and more convenient method compared to traditional mailing, allowing you to receive your tax refund faster. The IRS provides various filing options for small businesses to select from.

It is important to consider seeking assistance from a licensed tax professional if you have concerns about filing your taxes accurately. By working with a professional, you can ensure that you:

- Ensuring compliance with tax regulations

- Submitting the correct tax payments

- Gaining a clear understanding of your tax refund

-

Ensure Timely Payment Of Small Business Taxes

For many businesses, it is necessary to make estimated tax payments at regular intervals throughout the year. If you fall under the categories of sole proprietorship, partnership, S corporation, or corporation and anticipate owing more than $1,000 or $500 respectively, you are responsible for making quarterly estimated tax payments.

To make these payments, you have the option to utilize the IRS website, the IRS2Go app on your mobile device, or mail in Form 1040-ES. Failure to make estimated tax payments or underpaying your taxes may result in penalties imposed by the IRS.

It is important to note that even if you make quarterly tax payments, you still need to file an annual small business tax return and calculate your tax liability for the year. If your quarterly payments were insufficient, you will be required to pay the remaining amount when filing your tax return.

Although there may still be an amount owed at the end of the year, making quarterly small business tax payments can significantly reduce your final tax bill.

Features Of QuickBooks Taxes

-

Track Income And Expenses:

QuickBooks allows you to accurately track your business’s income and expenses throughout the year. It automatically categorizes transactions, making it easier to calculate and report your tax obligations.

The software provides comprehensive tax reports that summarize your financial data relevant to tax filing. These reports include profit and loss statements, balance sheets, and other essential information needed for tax preparation and reporting.

-

File Taxes Electronically:

With QuickBooks, you can conveniently file your taxes electronically directly from the software. It integrates with tax filing services, enabling you to submit your tax returns securely and efficiently. Electronic filing eliminates the need for manual paperwork and speeds up the tax filing process.

Top QuickBooks Accounting Software Alternatives

If you’re looking for an alternative to QuickBooks Online, there are many other accounting software options available. To help you choose the best option for your business, we’ve put together a comparison table of some of the top QuickBooks Online alternatives.

| | | |

| $15 per month (for the first six months, then $30 per month afterward) | $1.50 per month (for the first three months, then $5 per month afterward) | |

| Available for higher-tiered plans

Monday through Friday 6 a.m. to 6 p.m. Pacific time; Saturdays 6 a.m. to 3 p.m. PT | Phone 9 a.m. to 5 p.m. Eastern time | |

| | | |

QuickBooks Support

QuickBooks Support offers various resources to assist users in resolving issues and accessing helpful information. These resources include:

QuickBooks provides a live chat feature where users can engage in real-time conversations with support representatives. This allows for immediate assistance and resolution of queries or technical problems.

The QuickBooks Knowledge Base is a comprehensive online library of articles, guides, and frequently asked questions (FAQs) that cover a wide range of topics. Users can search for specific topics or browse through the available articles to find solutions to their questions or problems.

QuickBooks maintains a blog that serves as a valuable resource for users. The blog features articles, tips, and updates related to QuickBooks, accounting practices, tax regulations, and other relevant topics. It provides insights, industry news, and helpful advice to users looking to enhance their understanding and optimize their use of QuickBooks.

QuickBooks offers mobile support through its mobile applications. Users can access the QuickBooks mobile app on their smartphones or tablets to manage their finances, track expenses, create invoices, and perform other accounting tasks on the go. The mobile app also includes support features to address any issues or inquiries that users may have.

These QuickBooks Support resources aim to assist users by providing real-time assistance, access to a wealth of knowledge, up-to-date information, and the convenience of mobile support for seamless accounting operations.

Conclusion

QuickBooks is a powerful accounting software for small and medium-sized businesses. Its user-friendly interface and comprehensive features simplify financial management tasks, offering valuable insights. While not suitable for every industry, it remains a top choice for many organizations seeking an efficient and accessible accounting solution. With automation capabilities and robust reporting tools, QuickBooks streamlines workflows and enables better decision-making. Though some advanced functionalities may be lacking, its versatility and cloud-based accessibility make it a reliable option for businesses looking to streamline their financial processes.

Frequently Asked Questions

Before making a decision about whether or not to use QuickBooks Online, you may have some questions about the software. In this section, we’ll address some frequently asked questions about QuickBooks Online.

-

How to use QuickBooks Online?

QuickBooks Online is a cloud-based accounting software that offers a wide range of features and functionalities to help you manage your finances. To use QuickBooks Online, you need to sign up for a subscription plan, create an account, and set up your company profile. Then, you can start adding your financial transactions, such as income and expenses, and use the software to create and send invoices, pay bills, and access real-time financial reports.

-

Is QuickBooks worth it for small businesses?

QuickBooks Online can be a great investment for small businesses looking for a reliable and easy-to-use accounting solution. The software offers a range of features and functionalities that can help you manage your finances, track expenses, and reduce errors. Additionally, QuickBooks Online is accessible from anywhere and offers a variety of integrations with other business tools, such as payment processors and inventory management systems. However, it’s important to evaluate your business needs and budget to determine if QuickBooks Online is the right solution for you.

-

Is QuickBooks user-friendly?

QuickBooks Online has a user-friendly interface and can be easy to navigate for users with some experience using accounting software. However, some users may find the software to be complex and difficult to use, especially if they are not familiar with accounting software. Additionally, there may be a learning curve when first starting to use QuickBooks Online, as with any new software.

-

Does QuickBooks Online provide live bookkeeping support?

QuickBooks Online offers live bookkeeping support through its “QuickBooks Live” service. With this service, you can work with a virtual bookkeeper to get expert advice on managing your finances, help with data entry and reconciliation, and ensure that your financial reports are accurate and up-to-date. This service is available for an additional fee, and the cost varies depending on your business needs.

-

What integrations does QuickBooks Online offer?

QuickBooks Online offers a wide range of integrations with other business tools, such as payment processors, inventory management systems, and customer relationship management software. Some of the most popular integrations include PayPal, Shopify, Stripe, and Salesforce. These integrations can help you streamline your business processes and improve efficiency.

-

Does QuickBooks Online offer a mobile app?

Yes, QuickBooks Online offers a mobile app that allows you to access your financial data on-the-go. With the mobile app, you can manage your finances, send invoices, track expenses, and view financial reports from your smartphone or tablet. The mobile app is available for both iOS and Android devices and can be downloaded for free from the App Store or Google Play.

![Unlocking Ahrefs Premium: Get Ahrefs Premium Accounts [100% Free]](https://s44815.pcdn.co/wp-content/uploads/2023/10/Ahrefs-Free-Premium-accounts-2023-330x250.webp)