Key Features

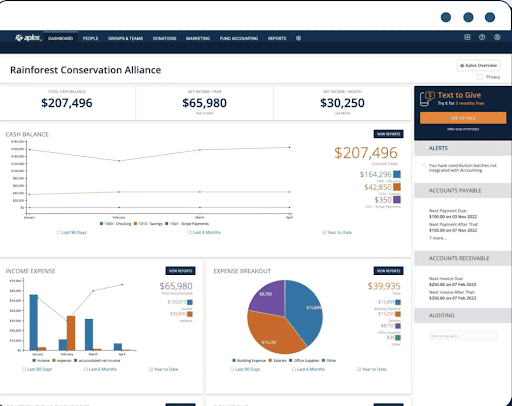

Dashboard

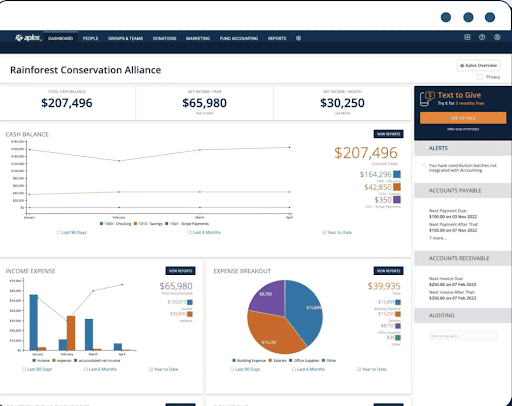

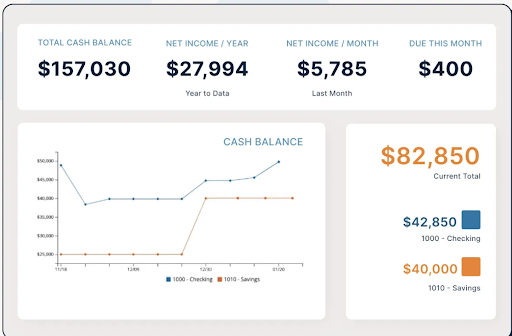

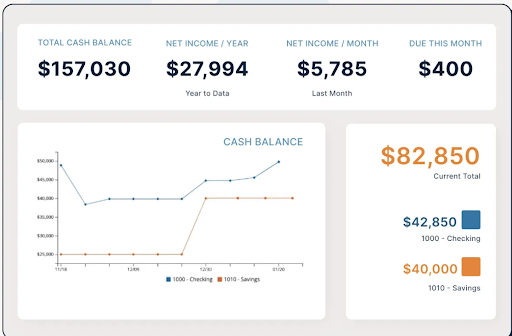

The Aplos dashboard has a neat interface that showcases financial reports and analytics. It is simple to understand, so regular employees can comprehend the data, with no need for an accountant to decipher it. One downside is that there is little room for customization.

CRM

Marketing is crucial for any organization, even non-profit ones. The Aplos CRM makes it easy to track donors and note all activities and communications. It is easy to manage and highly intuitive, which is vital for streamlining marketing operations and customer management.

Membership Management

Aplos also has a membership management feature to monitor the activities of everyone in the organization. It is especially important to track loyal members and encourage more participation from inactive ones. It also includes tools for recruiting new members.

Payroll Management

Aplos integrates with payroll and other business solutions for seamless tax filing, which helps streamline overall finances.

Donation Management

It is easy to track donations by donor or by batch. You can create a file for each donor and import Excel templates for easy tracking. Donors can also create their own accounts on the Aplos portal so they can access their records directly.

Asset Management

The feature is available with Advanced and Enterprise plans. This tool tracks all asset transfers, which is quite common in non-profit and faith-based organizations.

Accounts Payable and Receivable

Aplos generates complete financial reports, including accounts payable and receivable. The platform records every payment made, even partial ones. The accounts payable page shows all bills and their deadlines, with an indication of the number of days or weeks overdue. You can also get payable reports per donor.

The accounts receivable page is easy to understand and monitor. All data is recorded on the cash balance page, so you will have a better understanding of the organization’s financial health.

Bank Reconciliation

Aplos integrates seamlessly with most major American banks. Unfortunately, international banks are trickier to navigate. If you prefer not to connect directly to the organization’s bank for security reasons, you can still import and manage transactions manually.

Reporting and Analytics

You can generate income statements, balance sheets, and budget reports with Aplos. The platform makes it easy to maintain accurate and real-time documentation for donor management and statements of activities.

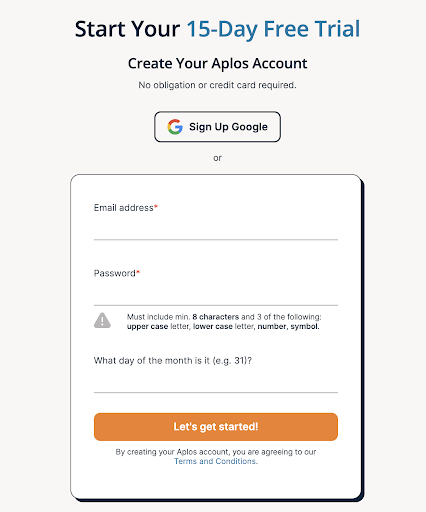

How To Set Up and Use Aplos Accounting Software

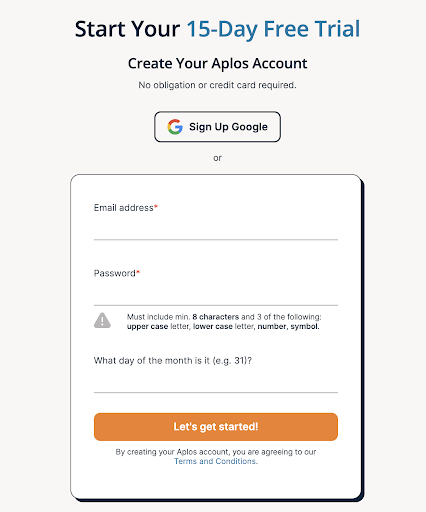

Aplos is very easy to use—even those with little to no experience with accounting software can use it without much difficulty. Don’t forget to take advantage of the 15-day free trial. You can also make a demo request to use the software before subscribing to a plan.

Here are the steps for setting up your Aplos account:

1. Create Your Account

You will only need an email address to get started. It is best to use the organization’s official email address to ensure easy access for all team members moving forward.

2. Choose Your Subscription

If you are a new non-profit organization or a small church, subscribe to the Basic subscription and just add other services you need. The Basic subscription is affordable, and you can upgrade when you scale. For bigger and more established organizations, the Advanced and Enterprise subscriptions may be a better choice.

3. Add Your People

Next, you must appoint administrators to your account. You can assign two admin users for all plans—additional admins will incur add-on fees.

Then, input your list of donors. You can easily import Excel files for this. And finally, you can add a list of vendors and suppliers for easy tracking.

3. Fill Out Your Chart of Accounts

The Aplos Chart of Accounts is already pro forma; you just need to fill it out with the organization’s account details and balances. You can add a fund source, new account, or account group with its own fund and indicate the status of any account.

The accounts can also be segmented for easy browsing. Here, you can connect your bank account for seamless transfer and recording of funds.

4. Create a Budget

The budget outlines your fiscal year. You can project income based on previous records and estimate expenses in the same manner. It’s a great way to evaluate your finances at the end of the year and gauge if you have met your goals.

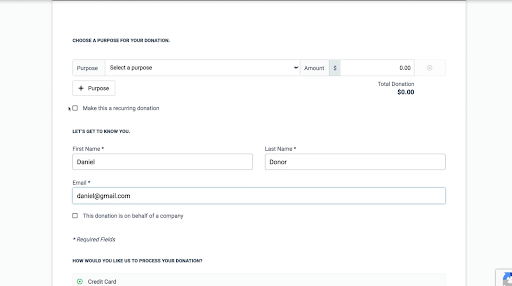

5. Create Purposes

Link your purposes to the Donations page. For example, you have scheduled a weekend feeding program for underprivileged families. Create a page for this purpose, along with relevant accounts. This makes tracking finances much more manageable.

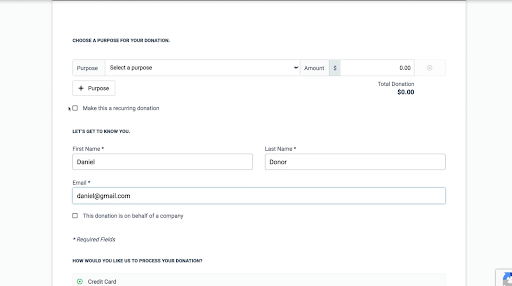

6. Set Up Online Donation Form

Some donors prefer to send recurring donations, so they don’t regularly receive requests or have to bother going to the website. An online donation form makes it easier for them and for your organization.

7. Invite Users

All Aplos subscriptions include unlimited users. You can create a group or team board to facilitate communication and manage important activities within your organization.

8. Navigate and Optimize Aplos Features

Navigate and learn the platform so you can take advantage of its many benefits to grow your organization. Certain tools can help with marketing and communications.

Performance at a Glance

| | |

| | Very easy to navigate, even for those without accounting backgrounds |

| | Features cater specifically to non-profit and faith-based organizations |

| | Basic subscription is affordable; Advanced and Enterprise can be pricey |

| | The platform has many tutorials, and all users can access customer support |

| | Aplos has a high rating on G2 |

Key Benefits of Using Aplos Accounting Software

Easy to Use

One doesn’t have to be an accountant to navigate the Aplos platform. The interface is very easy to understand. There are detailed tutorials for all features. The platform also has a dedicated Training Center page to help you with any specific issues.

Streamlined Dashboard

The dashboard shows all essential financial information, including account balance, income expense, and breakdown of expenses. You don’t have to dig through reports to look through critical data for your organization.

Great Features for Non-Profits

Fantastic features specifically cater to non-profit organizations and faith-based organizations. For example, donation management is top-notch. You can easily maintain records down to individual donors and each donation made.

The CRM also allows you to easily send personalized messages to your donors to solicit donations, invite them to events, or thank them for their continued support.

Real-Time Data

You can monitor cash balances and reports in real time.

Affordable Basic Plan

Newly created organizations or small churches can benefit from top-notch accounting features at an affordable price.

What Are the Alternatives To Consider?

If you are not sold on Aplos, check out these non-profit accounting software:

Bloomerang

Bloomerang is a complete donor management solution. It offers more subscription types ranging from $79 to $349, which accommodates the needs of a wide range of organizations. It is also easy to use with great customer support. Some users report glitches when it comes to software integrations.

Kindful

Kindful is a high-end donor management platform with comprehensive accounting features for established national and multinational non-profit organizations. Navigating the platform is quite complex, so it is best for a tech-savvy person to manage the account.

Product FAQs

Aplos is accounting software that specifically serves non-profit organizations and church-based groups. It is a donation management system for groups to track donations and monitor how their money is used.

Yes, Aplos is cloud-based. You can easily import your Excel sheets of donors, donations, and transactions.

-

Can you receive payments on Aplos?

Yes, you can receive payments or donations on Aplos. One of its best features is the online donation form, where donors can send money in just a few clicks. There is also a recurring donation feature where regular donors can automatically send a certain amount on a given date.

-

How do you do bank transfers on Aplos?

There are two ways to do bank transfers on the platform: via Register or Journal Entry. When you click on either feature, you will see a form that you need to fill out. Post that, you can complete the transaction by clicking Submit or Post.

A grant is considered a separate fund account, so you need to create a Fund in the Chart of Accounts. Once the grant has been registered as a Fund, you can track it through the Reports tab in the Accounting section.

Conclusion

It is important for non-profit and faith-based organizations to account for all the donations they receive and where the money goes. Accounting software like Aplos will make all of this much easier to manage.

Aplos is made precisely to accommodate the specific needs of these organizations that routinely receive donations from hundreds or even thousands of donors. It is undoubtedly an excellent product that will make accounting a breeze for any group that uses it.

Sources

https://www.aplos.com/

https://fitsmallbusiness.com/aplos-review/

https://www.g2.com/products/aplos/competitors/alternatives

![Unlocking Ahrefs Premium: Get Ahrefs Premium Accounts [100% Free]](https://s44815.pcdn.co/wp-content/uploads/2023/10/Ahrefs-Free-Premium-accounts-2023-330x250.webp)