Performance at Glance

| Xero Accounting Software Star Rating At Glance | |

| | Xero is a user-friendly software, which is quite easy to run, even for the beginners. |

| | It is very quick and easy to set up the software in your devices and get going with it. |

| | It is noticed that although it is reasonable for its pricing, it is definitely not the cheapest option. |

| | Xero offers a wide range of accounting services to their clients. |

| | By far, the customer support service is great but there is still some room for improvements. |

| | Based on the customer rating, Xero Software has an excellent G2 rating. Hence, one can trust the service. |

The ratings in the table are based on the experiences of users of Xero Accounting Software. Going through these ratings can help businesses or individuals to make an informed decision about whether Xero software fits well with their requirements or not.

Features Of Xero Accounting Software

Xero best accounting software is an excellent one-stop platform for the businesses that are willing to simplify their accounting and financial needs. Using this software gives them greater control over their finances. Moreover, there are a wide range of features that you can take advantage of while using Xero Accounting Software. Let’s have a look at them:

Significant Features of Xero Accounting Software

Xero Accounting Software is a popular cloud-based accounting solution that offers a range of features designed to help businesses manage their finances more efficiently. Some of the key features of Xero include:

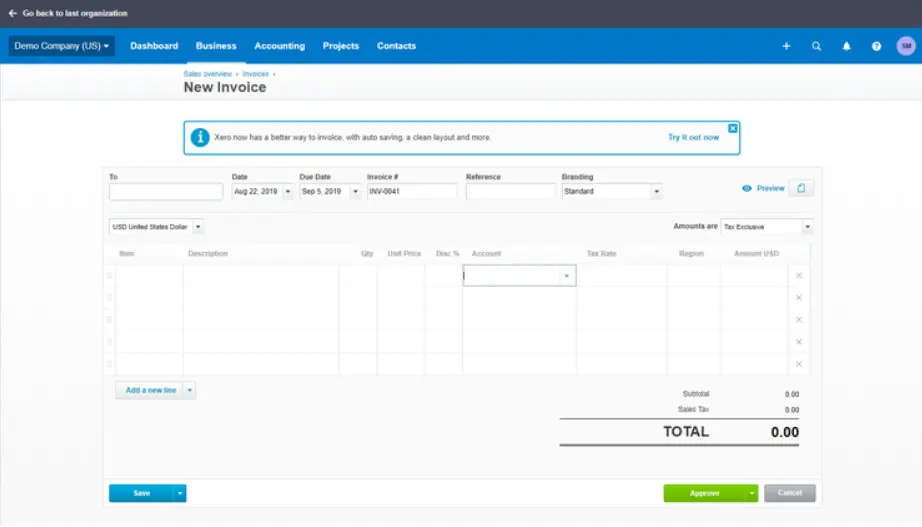

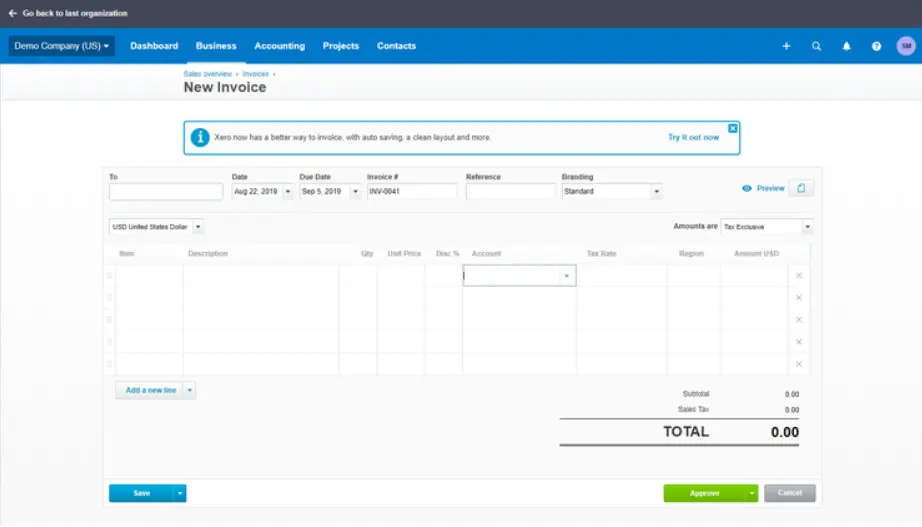

Invoicing

Xero Accounting Services offers a powerful invoicing feature that allows businesses to create and send customized invoices quickly and easily. Invoices can be tracked, with automatic payment reminders and online payment options available. Xero’s invoicing feature integrates with other accounting records, simplifying the process of reconciling accounts and improving cash flow management.

Expense Claims

The Expense Claims feature simplifies the process of claiming expenses for businesses. With this feature, employees can easily capture receipts and submit claims for reimbursement. The software also integrates with bank feeds, making it easy to reconcile expenses with accounting records. It improves accuracy and reduces the risk of errors in expense reporting, saving businesses time and improving overall financial management.

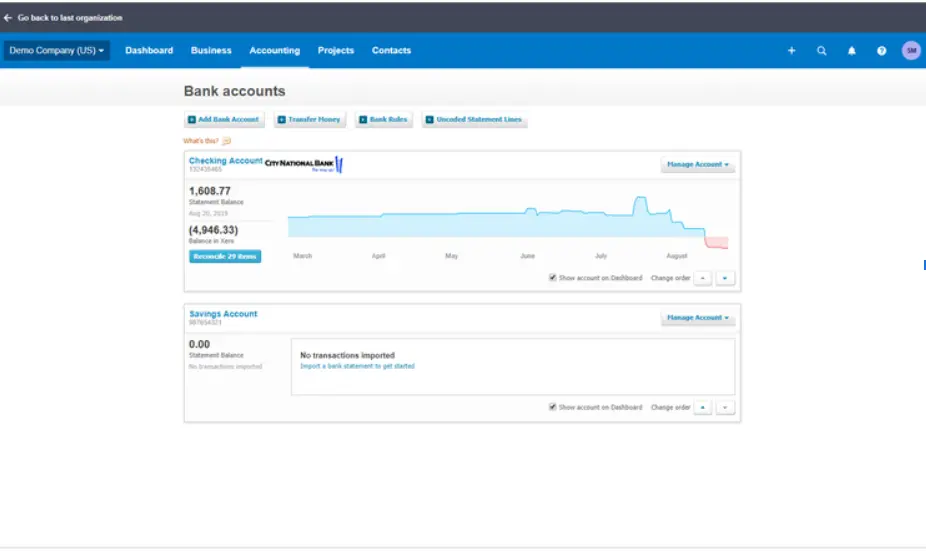

Bank Connections

It allows businesses to connect their bank accounts directly to the software, making it easy to import and reconcile transactions. With bank feeds, businesses can quickly see their current cash position, monitor cash flow, and stay up-to-date with their financial records. The bank connection feature saves businesses time and reduces errors in financial reporting, improving overall financial management.

Accept Payments

Xero Accounting Software’s accept payment feature allows businesses to accept payments directly through the software. Through this, businesses can set up online payment gateways, making it easy for customers to pay invoices and reducing the risk of errors. The software integrates with multiple payment platforms, making it easy for businesses to offer a variety of payment options.

Track Projects

It is an invaluable tool for businesses to manage their projects seamlessly from beginning to end. By creating projects and assigning tasks, businesses can monitor progress in real-time, allowing for informed decision-making and ensuring timely completion within budget constraints. Moreover, the Track Projects feature integrates with other components of the software, streamlining project-related expense management, invoicing, and payment processes.

Payroll with Gusto

The Payroll With Gusto feature is a game-changer for businesses looking to streamline their payroll processes. By automating the entire payroll process, businesses can save valuable time and reduce the likelihood of errors. Its integration with tax calculations, compliance requirements, and direct deposits makes it a one-stop-shop for managing payroll while staying in compliance with regulations. Furthermore, by providing employees with self-service portals, businesses can offer a seamless and efficient way to access information on their pay history, benefits, and employee data.

Capture Data

Xero’s mobile app lets users capture receipts and expenses on-the-go, making it easy to track expenses and manage finances from anywhere. With its user-friendly interface and integration with other Xero Accounting Software features, it’s a must-have tool for businesses looking to stay on top of their finances seamlessly, even when they’re on the move.

Resume Parsing

The resume parsing feature streamlines the recruitment process for businesses by quickly extracting relevant information from resumes. Using advanced machine learning algorithms, the software can analyze hundreds of resumes and extract key data points with a high degree of accuracy. The extracted data is then presented in a clear format for easy review by recruiters and hiring managers. Moreover, it seamlessly integrates with other parts of the software, allowing businesses to manage their recruitment process from start to finish.

Manage Fixed Assets

Keeping track of fixed assets is an important part of any business’s accounting process, and Xero’s fixed asset management feature makes it easier than ever. It allows businesses to easily track the depreciation of their assets over time, helping them stay compliant with accounting standards and regulations. It is easy to use and intuitive, allowing businesses to quickly add new assets, track their value, and calculate depreciation.

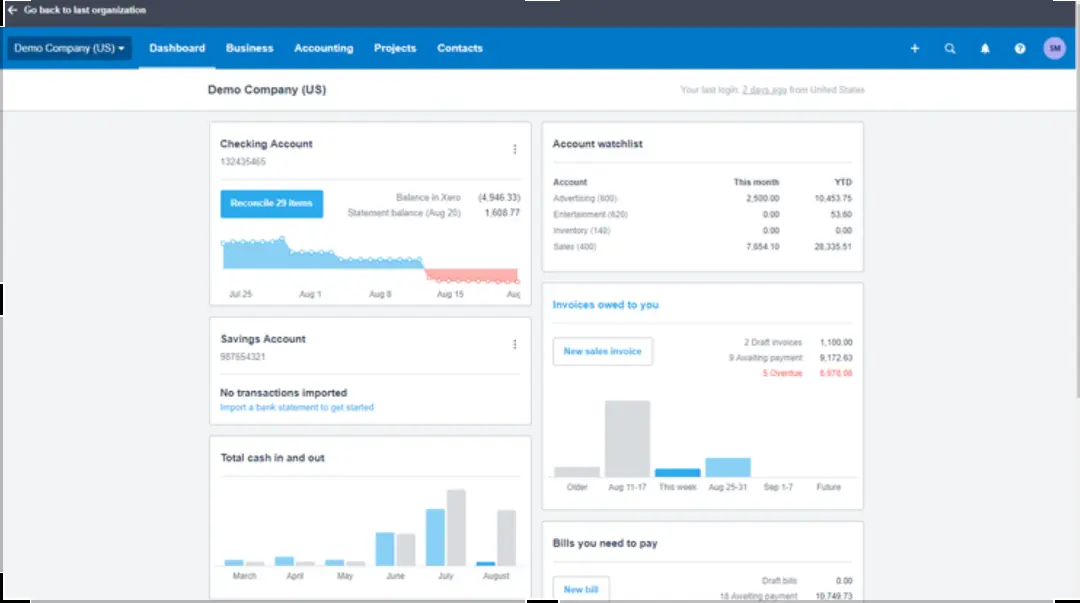

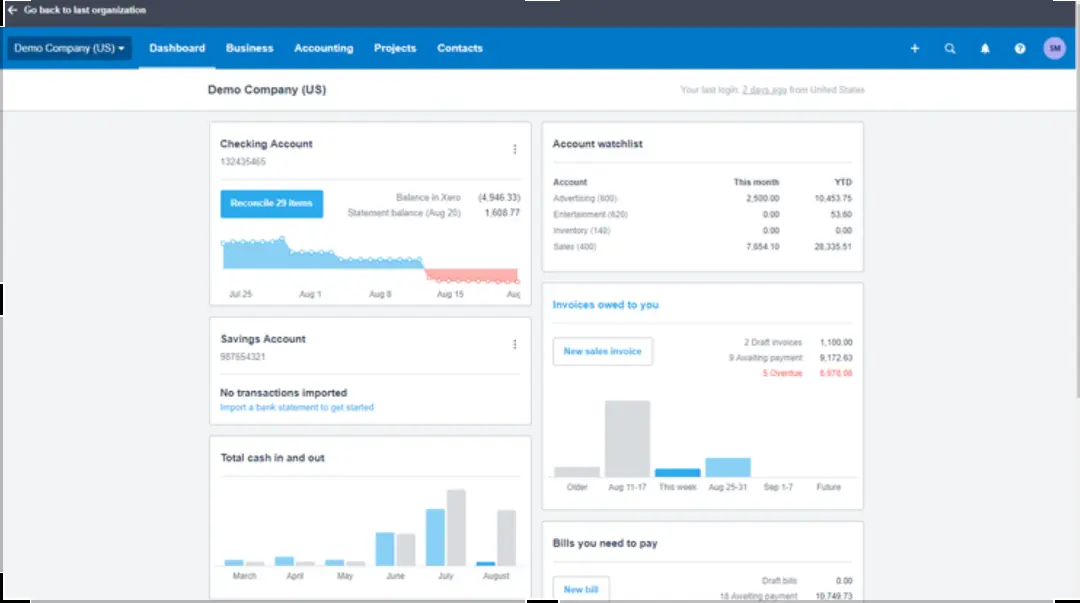

About Xero Dashboard

One standout attribute of Xero is its user-friendly Dashboard.

Highly intuitive and customizable, this Dashboard empowers you to curate the displayed information according to your preferences.

Essential details like prevailing bank balances, the invaluable Account Watchlist pinpointing your primary expenditure areas, and upcoming bill reminders are all at your fingertips.

Business Module: A Comprehensive Toolkit For Efficient Business Management.

This module encompasses seamless invoicing, streamlined quoting, bill management, and expense tracking to empower your operations.

Craft polished invoices featuring your branding elements and logos. Choose to send invoices directly from your mobile device or opt for the traditional print and mail route.

Stay informed at a glance with the sales overview screen, providing insights into invoicing status, pending drafts, and overdue payments. Customizable details like discounts can be added when introducing new customers or vendors.

- Effortless bill management:

The bill entry process mirrors the simplicity of invoicing, featuring intuitive lookup fields. Assign expenses directly to customers, ensuring precise accounting. The purchases overview screen offers a swift summary of pending payments and overdue bills.

- Enhanced inventory management:

Keep track of stock levels effortlessly. Configure stock parameters, and let Xero handle automatic inventory updates for purchases and sales. Seamlessly integrate quotes and purchase orders to maintain a cohesive workflow.

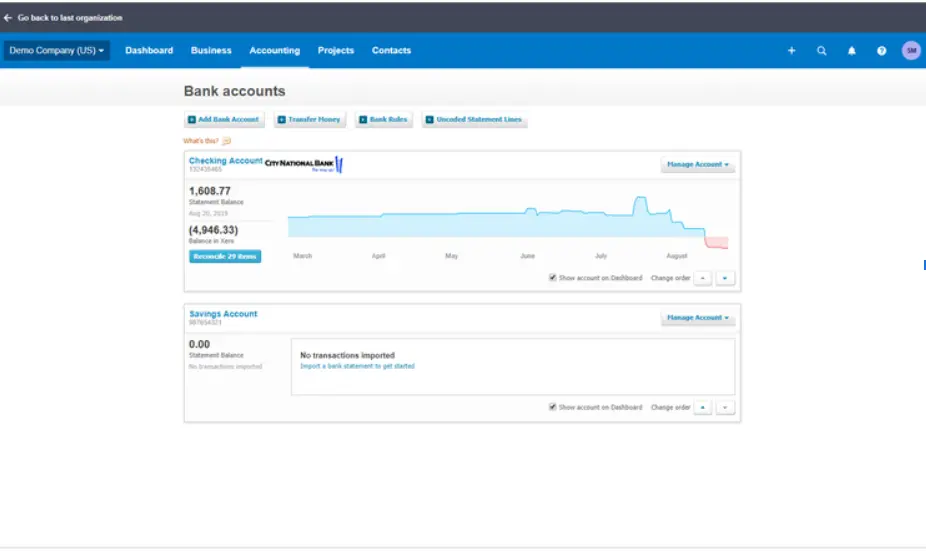

Accounting Module: Efficient Financial Management

In Xero’s Accounting module, you gain control over your bank account details while also harnessing the power of comprehensive reporting capabilities.

- Flexible Chart of Accounts and Journal Entries

Easily edit your chart of accounts or input manual journal entries within this module. Xero’s underlying double-entry accounting remains seamless, designed with your ease of use in mind.

- Streamlined Journal Entry Process

While Xero caters to business owners without extensive accounting knowledge, its manual journal entry process is user-friendly. Create recurring entries with defined start and end dates, offering enhanced efficiency.

- Drafts, Reversals, and Accruals

Choose between draft and post options for your journal entries. Xero empowers you to easily reverse entries, a useful feature for handling accruals.

- Bank Account Management Made Easy

Navigate and manage your connected accounts within the intuitive bank accounts screen. Add new bank accounts or perform inter-account transfers with ease.

- Enhanced Reporting Capabilities

Xero continuously enhances its reporting suite, introducing new options regularly. Enjoy the flexibility of creating and saving customized reports. Access financial, tax, sales, purchases, accounting, and inventory reports.

- Insightful Inventory and 1099 Reports

Access aged payables, aged receivables, and insightful inventory reports. Identify product performance trends effortlessly, and utilize the 1099 report to facilitate year-end contractor reporting.

- Comprehensive Business Performance Dashboard

Xero’s main and business performance dashboards offer comprehensive insights. Customize displays with your preferred business metrics.

Discover the Budget Manager within the Reports category. Create overarching business budgets or tailor them to specific departments or projects. Import budgets from external applications or export them for further customization.

Projects Module: Streamline Your Project Management And Time Tracking

Whether it’s a single project or a series of tasks, Xero empowers you to effortlessly manage project-related activities. Create multiple invoices as the project progresses or consolidate them into a single statement upon completion.

Keep a close eye on project performance with real-time insights, ensuring successful outcomes and preventing potential delays.

Contacts Module: Simplify Contact Management By Centralizing All Interactions

Seamlessly handle various stakeholders – vendors, contractors, customers, and even employees – from one convenient location. Enhance organization by establishing groups and smart lists, enabling efficient tracking of frequent buyers or those with delayed payments.

Xero offers robust import and export capabilities, ensuring hassle-free data management. Easily import contacts, budgets, bank statements, and PayPal records using the CSV file format.

Furthermore, effortlessly export reports and data in CSV or Excel formats. Although Xero does not include payroll services in its plans, integration with Gusto offers a solution for payroll management.

Xero Integrations

Unlock a world of seamless connectivity and efficiency with Xero’s array of integrations. Seamlessly sync your financial processes with leading platforms and tools, including:

- JRNITimestamp: Streamline time tracking and optimize resource allocation.

- Planyo Online Booking System: Simplify appointment scheduling and reservation management.

- Pipemonk: Effortlessly integrate and synchronize data between different applications.

- Zoho Creator: Create customized apps and automate processes to suit your unique needs.

- WorkflowMax: Manage projects, track time, and oversee job costing with ease.

- Deltek TrafficLIVE: Experience comprehensive agency management and resource planning.

- Gusto: Simplify payroll and human resource management for smooth operations.

Harness the power of these integrations to elevate your business processes and take your efficiency to new heights.

Is Xero Safe to Use?

Yes, Xero is safe to use. Xero takes security and data protection very seriously, and uses a range of measures to ensure that user data is secure. This includes encryption of data in transit and at rest, two-factor authentication, and regular security audits and updates. Xero also offers various permissions and access levels for users, allowing businesses to control who has access to what information within the software.

In addition to these technical measures, Xero also has a dedicated security team that monitors the system for potential threats and responds to any security incidents. Xero also complies with various international data protection regulations, including GDPR and CCPA, to ensure that user data is handled appropriately.

In short, Xero is a safe and secure platform for businesses to manage their accounting and financial information. By using Xero Accounting Software , businesses can be confident that their data is protected and secure, allowing them to focus on growing their business.

Quick Benefits of Xero’s New Software

Xero’s revolutionary new software has taken the accounting world by storm, setting a new standard for financial management in businesses of all sizes. Boasting a powerful feature set and an intuitive design, this software is a game-changer for anyone looking to streamline their financial processes.

The software’s user-friendly interface and intuitive navigation make it a breeze to use, even for those who are not tech-savvy. Plus, because it’s cloud-based, businesses can access their financial information from anywhere, at any time, making it incredibly convenient for those on the go.

One of the most impressive features of Xero’s new software is its robust reporting capabilities. Businesses can generate custom reports on a wide range of financial metrics, providing invaluable insights into their financial health. Armed with this information, businesses can make informed decisions about their future, setting themselves up for success.

Finally, the software’s seamless integration with other business tools is truly impressive. From CRM software to project management tools and even e-commerce platforms, Xero’s new software makes it easy to manage all aspects of your business from a single, centralized location.

How The Xero Software Will Benefit New Users?

Are you tired of spending countless hours managing your business’s finances? Look no further than Xero’s revolutionary new software! Designed specifically for businesses of all sizes, this software is sure to make your financial management processes a breeze.

-

It Has A User-Friendly Interface

Even if you’re not tech-savvy, the software’s intuitive design and easy-to-navigate dashboard make managing your finances a breeze. With just a few clicks, you can access all your financial information, including invoices, bills, and bank transactions.

Xero’s new software is also cloud-based, which means you can access your financial information from anywhere, at any time. Whether you’re on the go or working remotely, you’ll never be out of the loop when it comes to your finances.

-

It Offers Powerful Reporting Capabilities

With just a few clicks, you can generate custom reports on everything from accounts payable and receivable to inventory and payroll. These reports provide valuable insights into your business’s financial health, allowing you to make informed decisions about your future.

-

It Offers Seamless Integration

And if you’re worried about integrating the software with your existing systems, fear not! Xero’s new software seamlessly integrates with other business tools, including CRM software, project management tools, and e-commerce platforms. You can manage all aspects of your business from a single, centralized location, making it easier than ever to stay on top of everything.

-

Excellent Customer Service

But perhaps the best part? Xero’s new software comes with fantastic customer support. If you ever run into any issues or have questions about the software, Xero’s team of experts is always there to help you out.

How Does Xero Software Benefit Small Businesses?

Small businesses often face a unique set of challenges when it comes to managing their finances. These challenges can range from limited resources and time to a lack of financial expertise, making the task of managing finances seem daunting. However, Xero’s innovative software can help small businesses overcome these challenges and take their financial management to the next level.

Xero’s software is designed to be user-friendly and intuitive, so even those without a financial background can use it with ease. Its dashboard is easy to navigate, and its interface is simple and straightforward. Moreover, the software is continually updated, ensuring that users always have access to the latest features and tools.

One of the most significant advantages of Xero’s software is its robust reporting capabilities. Small business owners can generate custom reports on various aspects of their finances, such as accounts payable and receivable, inventory, and payroll. These insights enable small business owners to make informed decisions about their financial health and plan for the future.

Xero’s software also seamlessly integrates with other business tools, such as CRM software, project management tools, and e-commerce platforms. This integration allows small business owners to manage all aspects of their business from one centralized location, saving time and streamlining processes.

Another significant benefit of Xero’s software is its cloud-based access. Small business owners can access their financial information from anywhere, at any time, using any device with an internet connection. This feature provides the flexibility and convenience that modern businesses require, allowing small business owners to work from anywhere and at any time.

Finally, Xero’s software is an ideal solution for small businesses looking to simplify their financial management processes!

How Will The Xero Software Benefit Accountants?

Xero software provides a range of benefits for accountants that make their work much more efficient and effective. The software automates many accounting tasks, streamlining workflows, and freeing up accountants’ time to focus on higher-value tasks, such as providing strategic advice to their clients.

Real-Time Data Sharing Capabilities

This feature allows accountants to access their clients’ financial information in real-time, enabling them to provide up-to-date advice on financial matters. This information sharing also makes it easier for accountants to work collaboratively with their clients, ensuring that they are always on the same page.

Xero’s software also offers a wide range of accounting tools and features that help accountants to manage their clients’ finances more efficiently. These tools include invoicing, payroll, bank reconciliation, and reporting. Moreover, Xero’s software is constantly updating, ensuring that accountants have access to the latest features and tools, making their work more efficient and effective.

Cloud-Based Access

Accountants can access their clients’ financial information from anywhere, at any time, using any device with an internet connection. This feature provides the flexibility and convenience that modern businesses require, allowing accountants to work from anywhere and at any time.

Moreover, Xero’s software provides accountants with a higher level of security for their clients’ financial data. The software’s data encryption, two-factor authentication, and regular backups ensure that accountants can maintain their clients’ financial data secure and confidential, protecting their clients’ sensitive information.

Top Xero Accounting Software Alternatives

Xero is a popular cloud-based accounting software used by small and medium-sized businesses. However, there are several alternatives to Xero, including TallyPrime and Netsuite. Here’s a detailed overview of these two accounting software solutions:

| | | |

| | | |

| | | |

| | | |

| | | |

| Cloud, SaaS, Web-Based, Mobile - Android Mobile - iPhone Mobile - iPad | Cloud, SaaS, Web-Based Desktop - Windows On-PremiseWindows On-Premise - Linux | Cloud, SaaS, Web-Based Mobile - Android Mobile - iPhone Mobile - iPad |

| Email/Help Desk FAQs/Forum Knowledge Base 24/7 (Live Rep) Chat | Email/Help Desk FAQs/Forum Knowledge Base Phone Support Chat | Email/Help Desk FAQs/Forum Knowledge Base Phone Support 24/7 (Live Rep) Chat |

| In Person Live Online Webinars Documentation Videos | Webinars Documentation Videos | In Person Live Online Webinars Documentation Videos |

TallyPrime

TallyPrime is a popular accounting software that is widely used by businesses in India. It offers a range of features, including accounting, inventory management, invoicing, payroll processing, and tax compliance. Here are some of the key features of TallyPrime:

- Accounting: TallyPrime enables businesses to manage their accounts and finances with ease. It allows businesses to track their expenses, generate invoices, and manage their bank accounts.

- Inventory Management: TallyPrime enables businesses to track their inventory levels, manage their stock transfers, and generate purchase orders.

- Invoicing: TallyPrime enables businesses to generate professional-looking invoices quickly and easily. It also allows businesses to customize their invoices with their branding and logo.

- Payroll Processing: TallyPrime enables businesses to manage their payroll processing, including salary calculation, tax deduction, and generating payslips.

- Tax Compliance: TallyPrime helps businesses stay compliant with local tax laws by providing features like tax calculation, tax returns, and GST compliance.

Netsuite

Netsuite is a cloud-based business management software that offers a range of features, including accounting, inventory management, CRM, and e-commerce. Here are some of the key features of Netsuite:

Accounting: Netsuite offers a range of accounting features, including general ledger, accounts payable, accounts receivable, and financial reporting.

- Inventory Management: Netsuite enables businesses to manage their inventory levels, track their stock transfers, and generate purchase orders.

- CRM: Netsuite offers a range of CRM features, including lead management, opportunity management, and customer segmentation.

- E-commerce: Netsuite enables businesses to create and manage their online store, including inventory management, order management, and payment processing.

- Multi-Currency Support: Netsuite supports multiple currencies, making it ideal for businesses that operate in different countries.

Overall, both TallyPrime and Netsuite are popular accounting software alternatives to Xero. TallyPrime is ideal for businesses in India, while Netsuite is ideal for businesses that require a more comprehensive business management solution.

How Do You Create Contact Records In Xero?

Creating contact records in Xero is a simple process that involves a few steps. Here’s a detailed overview of how you can create contact records in Xero:

Step 1: Log In To Xero

First, log in to your Xero account using your login credentials.

Step 2: Go To The Contacts Page

Once you are logged in, click on the ‘Contacts’ tab on the navigation menu at the top of the screen. This will take you to the Contacts page, where you can view and manage all of your contacts.

Step 3: Click On ‘Add Contact’

On the Contacts page, click on the ‘Add Contact’ button on the top right corner of the screen. This will open a new contact form where you can enter the details of the new contact.

Step 4: Enter Contact Details

In the new contact form, enter the contact details of the new contact. This can include the contact’s name, email address, phone number, billing address, and other relevant details. You can also choose to upload a profile picture for the contact.

Step 5: Save The Contact

Once you have entered all the necessary details for the new contact, click on the ‘Save’ button at the bottom of the form. This will create the new contact record in Xero.

Step 6: Edit Or Delete Contact Records

If you need to make any changes to a contact record or delete a contact, you can do so by selecting the relevant contact from the Contacts page and clicking on the ‘Edit’ or ‘Delete’ button.

That’s it! By following these simple steps, you can create contact records in Xero and manage your contacts effectively. Xero also allows you to import and export contact records in bulk, which can save you time if you have a large number of contacts to manage.

How To Use Tracking Inventory In Xero?

Tracking inventory in Xero can be a valuable tool for businesses that need to manage their inventory levels and costs. Here’s a detailed overview of how to use tracking inventory in Xero:

Step 1: Enable Inventory Tracking

To begin tracking inventory in Xero, you first need to enable inventory tracking in your account settings. To do this, go to ‘Settings’ and select ‘Inventory Items.’ From there, click on ‘Enable’ to activate inventory tracking.

Step 2: Set Up Inventory Items

Once inventory tracking is enabled, you can create new inventory items by going to ‘Inventory Items’ and selecting ‘New Item.’ You will need to enter details such as the item name, description, unit of measure, and selling price.

Step 3: Set Up Inventory Opening Balances

After you have created your inventory items, you can set up opening balances to reflect the initial stock levels of each item. To do this, go to ‘Inventory Items’ and select the item you want to set up. From there, click on the ‘History and Adjustments’ tab and select ‘Add Adjustment.’ Enter the quantity and value of the opening balance, and click ‘Save.’

Step 4: Record Inventory Purchases

As you purchase new inventory items, you will need to record these purchases in Xero. To do this, create a new bill for the supplier, and select the inventory item and the quantity purchased. Xero will automatically update the inventory levels and cost of goods sold.

Step 5: Record Sales of Inventory Items

As you sell inventory items, you will need to record these sales in Xero. To do this, create a new invoice for the customer, and select the inventory item and the quantity sold. Xero will automatically update the inventory levels and revenue earned.

Step 6: Run Inventory Reports

Xero offers a range of inventory reports that can help you track your inventory levels, costs, and sales. You can access these reports by going to ‘Reports’ and selecting ‘Inventory.’ From there, you can run reports such as the inventory summary, inventory item details, and inventory movements.

By following these steps, you can use tracking inventory in Xero to effectively manage your inventory levels and costs, and make informed business decisions.

Stay Productive With The Xero Accounting App

Stay in control of your business, even on the move, with our efficient accounting app. Maximize your productivity during idle moments and manage your tasks from anywhere.

- Speedy Invoicing and Payments:

Send invoices promptly and accelerate your payment process. Craft, modify, and send invoices right from the mobile app as soon as tasks are completed.

- Effortless Tracking of Receivables:

Stay informed about your receivables effortlessly. Utilize the app to monitor both pending and overdue invoices, while also tracking payment statuses.

- Real-time Reconciliation:

Maintain up-to-date financial records on the go. Keep your small business books current, providing you with an accurate and immediate financial overview.

- Instant Cash Flow Insights:

Experience instant insights into your cash flow dynamics. The accounting app dashboard lets you visualize incoming and outgoing funds, ensuring clarity about your business’s financial health.

Conclusion

In conclusion, Xero is a cloud-based accounting software that offers a range of features and tools for small and medium-sized businesses. Xero allows users to manage their finances, track inventory, generate invoices, and more, all in one place. The software is user-friendly and easy to navigate, with a clean and intuitive interface.

One of the standout features of Xero is its integration with other software and applications, such as payment gateways, inventory management tools, and CRM systems. This allows businesses to streamline their workflows and automate many tasks, saving time and improving efficiency.

Xero also offers a range of reporting and analytics tools, which can help businesses make data-driven decisions and identify areas for improvement. The software is also highly customizable, with a range of add-ons and integrations available to tailor the software to the specific needs of your business.

While Xero is a powerful accounting software, it may not be suitable for all businesses. Larger businesses with more complex accounting needs may require a more robust solution, while smaller businesses may find the software’s pricing plans to be too expensive.

Overall, Xero is a great option for small and medium-sized businesses looking for a cloud-based accounting software that is easy to use, customizable, and offers a range of features and tools. With its intuitive interface, integration capabilities, and reporting tools, Xero can help businesses streamline their accounting processes and make better-informed business decisions.

Frequently Asked Questions

-

Can I Pay My Xero Subscription Annually?

Absolutely, Xero provides the flexibility to pay for your subscription either monthly or annually, catering to your choice. Opting for the annual payment might also unlock a discounted rate in comparison to the monthly option.

-

Can You Cancel Your Xero Subscription At Any Time?

Certainly, you have the freedom to cancel your Xero subscription whenever you wish, without facing any fees or penalties. Remember, canceling will restrict your access and might result in data deletion, so keep a backup of vital information prior to cancellation.

-

What Are The Downsides Of Xero?

Xero’s drawbacks include potentially high costs for complex businesses, overwhelming complexity for non-accountants, and reported customer support challenges. Furthermore, it may not fit businesses with highly specialized accounting needs.

-

Which Is More User Friendly, Xero Or QuickBooks?

Xero and QuickBooks share user-friendly interfaces and features. Yet, Xero is often deemed more intuitive, while QuickBooks boasts a distinct layout. Choose based on your business needs and personal preference. Trying both helps identify the ideal fit.

-

How Many Users Can Use Xero Pricing?

Xero’s pricing involves a subscription model for one user. Additional users can be added for a fee. Plans like “Standard” permit two users, “Premium” allows five, and an “Early” plan suits solo users. User count depends on the chosen plan.

-

Can You Get Xero For Free?

Experience Xero for free. Enjoy full access to all features for 30 days before choosing the right plan for your business.

-

Can I Use Xero Without An Accountant?

Yes, Xero can be used without an accountant, but it’s advised to collaborate with one for business success.

![Unlocking Ahrefs Premium: Get Ahrefs Premium Accounts [100% Free]](https://s44815.pcdn.co/wp-content/uploads/2023/10/Ahrefs-Free-Premium-accounts-2023-330x250.webp)